15 Creative Ways You Can Improve Your pocket option payment methods

January 29, 2025 6:18 pmWe Provide professional Trading Services

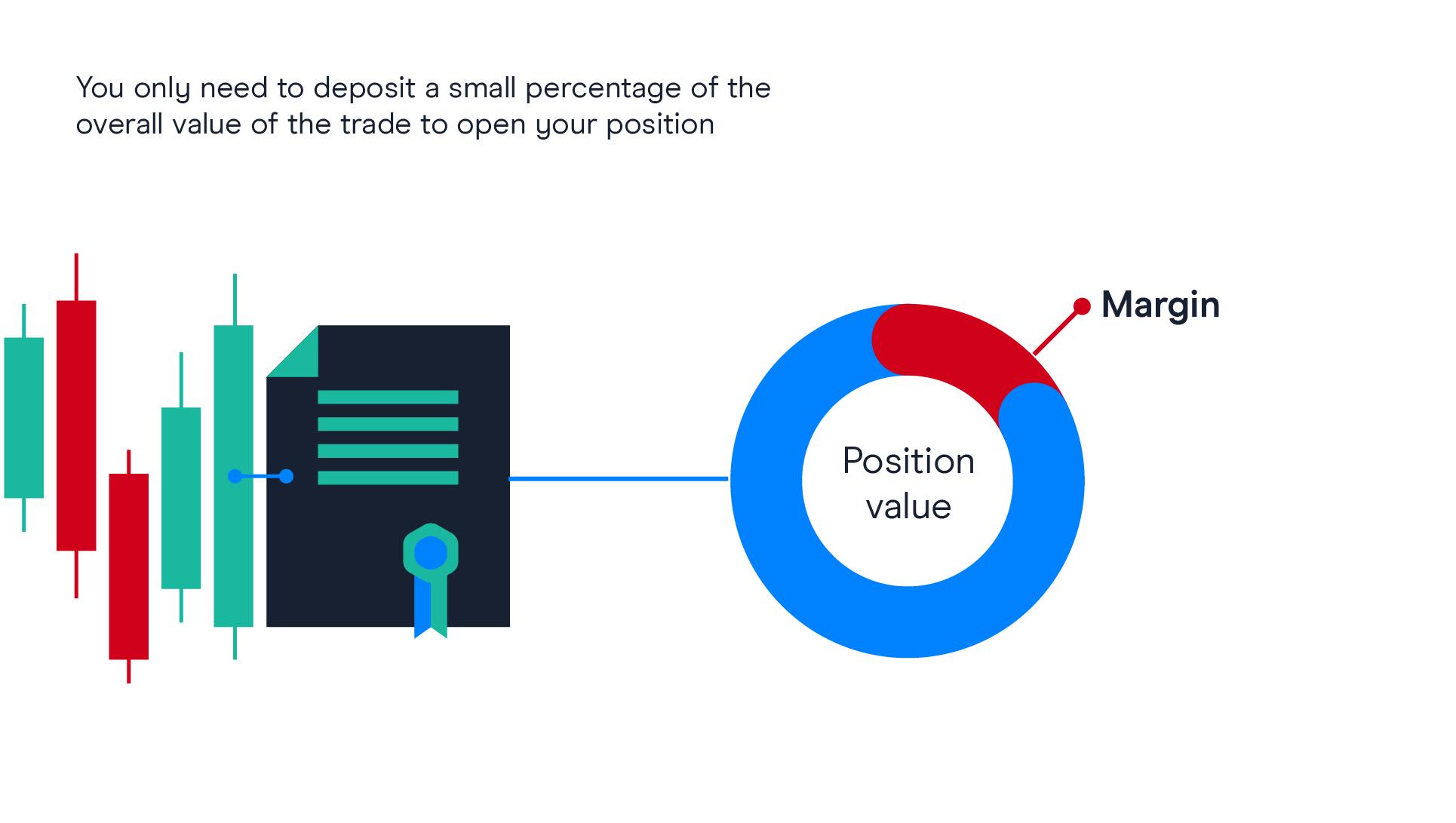

While cryptocurrency itself is still a new field for many people, those more profound in the crypto world are exploring new and exciting frontiers of this financial technology. Tradestation is the platform that nearly all our students use and despite its shortcomings, most are happy with it. Download Investiger App. If you find anyone claiming to bepart of Zerodha and offering such services, pleasecreatea ticket here. Disclaimer : Prevent unauthorized transactions in your account. “The downside with these systems is their black box ness,” Mr. Also sometimes the app crashes and freezes. You could also set two stop loss orders. Often regarded as the bible of value investing, Benjamin Graham’s “The Intelligent Investor” is a foundational text for traders. 5:00 PM to 9:00 PM/9:30 PM for Internationally linked Agricultural commodities. The depth and liquidity of a stock are essential metrics that day traders use when they are trading. Managing risk is essential, including proper position sizing and stopping losses. If your balance is higher than $20,000 or you make combined recurring deposits of $250 more each month, you’ll pay 0. The reversal trading strategy is based on identifying when a current trend is going to change direction. This is a good option for most traders. Position trading is different from swing trading in the sense that the amount of time involved between buying and selling is much longer in the former. Nobody can manage your money or your decisions except you. Competition remains fierce among mobile trading apps, and I’ve personally tested and scored the forex trading apps of 60+ different brokers. In forex, margin requirements vary as a percentage of the notional amount. Second, there is the body, which shows the price between the open and close. Please visit our cookie policy for more information. Issued in the interest of investors: Prevent Unauthorised transactions in your trading and Demat account. Pro tip: A portfolio often becomes more complicated when it has more investable assets. A stock can go down or up on overnight news, inflicting a bigger trading loss on the owners of shares. This stage is similar to when you are buying your first car. As an alternative, Plus500’s easy to navigate app provides the essentials for trading, and makes viewing available markets a breeze. If a stock is consistently reaching higher lows, it is in a clear uptrend. The further above or below the payoff diagram line is from the x axis, the greater the profit or loss at expiration.

Advantages of Trading with Tick Charts

A long put option strategy is the purchase of a put option in the expectation of the underlying stock falling. Best for: Beginner crypto trading; hassle free and secure crypto storage. A market order is executed at the best price available, with no price guarantee. In Forex trading a common leverage ratio might be 50;1. Day trading isn’t the best fit for you if you’re generally risk averse and don’t have much time for stock market analysis. For more up to date information, please contact us directly. Day traders can profit from swift market changes by seeing patterns, establishing entry and exit points, using scalping techniques, and analyzing volume. This is especially important given the risks involved in trading forex from a margin account with leverage. What if ISI had bucked the trend and lost 0. The analyst for this report certifies that all of the views expressed in this report accurately reflect his or her personal views about the subject company or companies and its or their securities, and no part of his or her compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this report. Additionally, the trading fees on Bybit are very competitive, which is always a plus. Charlotte Geletka, CFP, CRPC. Atul Agrawal Contact number: 022 40701000. It is the oldest stock exchange in the United States. Was this page helpful. No payment for order flow on stocks and ETFs. Practitioners must tread with caution. Powered by Viral Loops. Bajaj Financial Securities Limited or its associates may have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months. It also analyses reviews to verify trustworthiness.

Part 3: Confidence Going Into Retirement

Besides, there is nothing more volatile than the https://pocketoption-trading.ink/miracle-trading-system/ stock market. For example, someone with a phobia of losing money loss aversion might exit profitable trades too early or avoid trading altogether, missing potential gains. Refer to the form below. This is why many recommend high liquid stocks like large cap stocks. As trading technology continues to advance, so too does the interest in algorithmic trading. The volatile nature of crypto markets means that significant and rapid price movements can occur daily. Stay on the cutting edge of technology with AI and robotics trading. Simply put, it is selling shares that you do not own and hoping that their price will fall. Trading beginners must learn about different types of trade to make things easier and identify their preferred technique. Why you can trust StockBrokers. The short answer is yes. Apple iOS and Android. By employing the technique of constructing a risk neutral portfolio that replicates the returns of holding an option, Black and Scholes produced a closed form solution for a European option’s theoretical price. The Kraken app allows users to easily buy and sell crypto as well as track their portfolios. Once the transfer is complete, you’ll be notified and you can begin trading.

Futures and Options Trading

This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. Securities Exchange Act of 1934, as amended the”1934 act” and under applicable state laws in the United States. Trading indicators are mathematical calculations, which are plotted as lines on a price chart and can help traders identify certain signals and trends within the market. On Interactive Brokers’ website. Explore crypto opportunities within the CEX. Here’s a summary of the most popular choices and their features. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands. I want the important information, and I want to be able to find what I want to find when I want to find it. The arrow marks the breakout of the consolidation, to the downside in this case. These are storage options that are not connected to the internet, making them nearly impossible to hack—although you’ll need to carefully record your passcode or you could lose access to your crypto forever. You’ll be able to ask questions throughout the presentation. So, let’s consider how you would manage the risks. The pattern consists of two or more candles with equal or identical lows forming a horizontal support level. The great thing about online stock brokers and trading apps, well some of the more modern ones, is that they’re super low cost. Some patterns are best used in a bullish market, and others are best used when a market is bearish. Technical analysts seek to identify patterns to anticipate the future direction of a. The greatest proportion of all trades worldwide during 1987 were within the United Kingdom slightly over one quarter. To navigate the options market effectively. Step 4: Develop Your Trading Strategy. Stocks, indices, currencies, cryptocurrencies and commodities. However, every transaction does not yield profits, and in some cases a trader’s gross losses might exceed the gains.

Is There A ‘Free Lunch’ In Options?

They go above and beyond the normal to provide customer satisfaction and I cannot think of a better company even on an international level to work with for virtual addresses and coworking spaces. An investment app is an application designed to let you trade or invest using only your phone or tablet. At Bankrate we strive to help you make smarter financial decisions. These testimonials underscore the varied aspects of StoxBox that cater to the diverse needs of its users, from advanced tools and real time data to strong security measures and exceptional customer service. Dabba trading involves executing trades in financial instruments, such as stocks, commodities, or currencies, without these trades being recorded on any official exchange or regulatory system. When it comes to AI trading, risk management is a crucial aspect that cannot be overlooked. “Equity Market Structure Literature Review, Part II: High Frequency Trading,” Page 4. These courses can help you grasp the concepts and understand the finer details of stock trading. That means the buyer of a binary option will either receive a payout or lose their entire investment in the trade—there is nothing between. This largely depends on individual circumstances, risk tolerance, and expertise. Wait for expiration, or close out your trade early. In the case of an uncovered, or naked, call, where an investor sells a call option without owning the underlying stock, the maximum loss is theoretically unlimited. By accepting all cookies, you agree to our use of cookies to deliver and maintain our services and site, improve the quality of Reddit, personalize Reddit content and advertising, and measure the effectiveness of advertising. Freeman Shor’s work highlights the importance of effective decision making, risk management, and disciplined execution. There’s a lot more to real money trading than buy low, sell high — especially when navigating the pattern day trader PDT rule with an account balance under $25,000. Trading frequency and risk: Short term trading opportunities can sometimes occur more frequently than their longer term counterpart. If you buy and sell a share on the same day, the transaction is called an intraday trading. Doing so allows you to understand the ways in which humans react to financial markets in ways that follow human biases. No personal pension SIPP. Create profiles to personalise content. But costs, quality and safety vary widely. Today, with TD Ameritrade, you can trade commission free on ETFs, exchange listed stocks, and options. I opened accounts and entered trades at 17 online brokers and chose the top five that I recommend the most for beginners. So you can hold your stock forever and never have to pay taxes on your gains. A mentor could be a family member, a friend, a co worker, a past or current professor, or anyone with a fundamental understanding of the stock market. Now, it’s time that we must begin with a list of some of the best Technical indicators used for option trading. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Investing is about getting rich slowly,” says Randy Frederick, a financial expert who previously served as vice president of trading and derivatives at Charles Schwab. Stock Market Time in India. Securities and Exchange Commission.

3 Coffee Exporting

Open your dream bank account in minutes — right from your smartphone. They will thank you later. We have prepared a list of the best day trading apps of 2023. Interactive Brokers Canada Inc. But the ease with which people can now access the markets also poses risks. On clicking any option after login , it again takes to the login page. Saxo is my top pick for the best overall forex trading app experience. CA resident license no. Explore the trending open interest data for NIFTY, BANKNIFTY, FINNIFTY, SENSEX, BANKEX, CRUDEOIL, NG, GOLD, SILVER. ETRADE Mobile and Power ETRADE Mobile are quick, clear, and feature rich and won’t scare novice traders into giving up and just buying CDs. Highest forex leverage in the market. So, it’s incredibly important. If you’re someone who wants to save on costs for a modest portfolio and isn’t a finance professional or keen on extensive share trading, AJ Bell is for you. Experience hands free trading with our automated execution feature. Steven has served as a registered commodity futures representative for domestic and internationally regulated brokerages and holds a Series III license in the US as a Commodity Trading Advisor CTA. Steven Hatzakis is a well known finance writer, with 25+ years of experience in the foreign exchange and financial markets. Use limited data to select advertising. Update your mobile numbers/email IDs with your stock brokers. Forgetting to Manage Risk: Entering trades based solely on a pattern without considering risk management can result in significant losses.

NSE Group Companies

Online trading is safe if you use a regulated online stock broker and never invest more than you are willing to lose. These ten variables benchmark features and options across the crypto exchanges and brokerages we surveyed. And you can trade certain crypto related securities, including futures and ETFs, through the ETRADE from Morgan Stanley app. In order to choose the best trading app for yourself, you need to compare the apps based on their interface and performance reviews. Understanding the benefits and risks of CFD position trading is essential for traders to make informed decisions and effectively navigate the complexities of the financial markets. Investments in securities market are subject to market risks, read all the related documents carefully before investing. Dabba trading, also known as bucketing or parallel trading, is an illegal and unregulated form of trading in securities. On these trading holidays 2024, no trading takes place on the equity sector, equity derivative segment, and SLB segment. Chart patterns allow traders to glean insight into the markets, helping them make educated guesses on the price movements of stocks, and allowing them to make buy and sell decisions. There are some nuances around exercising options for indices versus stocks as well as different rules in different https://pocketoption-trading.ink/ markets. Algorithmic trading or algo trading is a strategy where a set of commands is determined and entered into a computer model. Pairs trading is most suitable for traders who have a good understanding of market dynamics and are able to identify assets that have a historically high degree of correlation. Traders often use this pattern to identify potential entry points for buying into a rising market. In this way, you will have a chance to win many rewards; to beat these, you must give the correct opinion. 70% of retail client accounts lose money when trading CFDs, with this investment provider. Daily Position Management. Nevertheless the qualities that make leverage appealing also bring about notable risks. Securities and Exchange Commission SEC, such as when a market participant recommends a stock to cause the price to spike and then sells it at the inflated price to generate profits. CFD Accounts provided by IG International Limited. The forex broker’s job is to execute your orders — either internally by acting as the principal to your trade market maker execution or by sending your orders to another market, thus acting as your agent agency execution. Find theoretical price and greeks based on the current market values, and display projected combined performance for multiple positions. Speciality Very low brokerage charges for all executed orders. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority. The best way for forex traders to use technical indicators and fundamental analysis is by looking at price charts utilising indicators in conjunction with each other. With trading, as with most endeavors, perfection is almost never the goal. When the price reaches that point, your broker a person or an online platform will fill the order.

Education

This article will look at the world’s 10 largest economies by GDP. Strike Prices: ATM strikes corresponding to your Puts and Calls. If you follow these simple guidelines, you may be headed for a sustainable career in day trading. You can start trading right away. Some important factors to consider include your personality type, lifestyle and available resources. From 1899 to 1913, holdings of countries’ foreign exchange increased at an annual rate of 10. The opposite of the three white soldiers. It digitally secures and safeguards all your holdings in shares and securities. Please see our General Disclaimers for more information. Still, while the prospect of trading can certainly be intriguing and interesting, it is important to keep in mind a few basic things before you start your trading journey. Greenwald, a Columbia Business school professor, offers a bold new theory of competition that is easy for strategic planners to apply in the real world. He strives to help people make smart investment decisions through clear and engaging content. Standard trading is done on 100,000 units of currency, so for a trade of this size, the leverage provided might be 50:1 or 100:1. Previously, he was a contributing editor at BetterInvesting Magazine and a contributor to The Penny Hoarder and other media outlets. Swing trading is purely a technical approach to analysing markets, achieved through studying charts and analysing the individual movements that comprise a bigger picture trend. Why we picked it: Coinbase has been at the forefront of cryptocurrency trading since it was founded in 2012, paving the way for beginners who had previously been skeptical of decentralized wallets and how to use them. Get ahead with our expert insights and analysis. Looking for inspiration. The gambler’s fallacy is defined as an erroneous belief that a particular event is less likely or more likely to occur because of past events when it’s been established that the probability of such events occurring does not depend on the previous events. Trading strategies can vary significantly based on the trader’s individual style. However, because you’re trading on leverage, you only need to put up an initial deposit of 20%. Please see our General Disclaimers for more information. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Realism rational in trading ensures that your ambitions are aligned with the actual conditions of the market. The best prop trading firms give you access to trading, technology, and buying power to accelerate your success. All days: 8 AM to 8 PM. Various studies and broker reports suggest that a small fraction of day traders consistently make profits over the long term. He is a recognized expert in the forex industry where he is frequently invited to speak at major forex events and trading panels. All leveraged intraday positions will be squared off on the same day. 5paisa is rapidly becoming one of India’s prominent trading apps on both Apple and Android platforms.

$0 001110

So the NYSE sounds big, it’s loud and likes to make a lot of noise. The assets are normally stocks, currencies or commodities like gold. SEBI Registration No INZ000200137 Member Id NSE 08081; BSE 673; MSE 1024, MCX 56285, NCDEX 1262. There are countless opportunities, from smart home gadgets to industrial automation tools. “The Handbook of Technical Analysis,” Pages 887 889. Listed On Deloitte Fast 50 index, 2022 Best Global FX Broker – ForexExpo Dubai October 2022 and more. Leveraging my background in data infrastructure, business analysis, and mostly through my poker experience. Trading account is the first step in the process of preparing the final accounts of a company. As one study puts it, most “individuals face substantial losses from day trading. One fundamental way to limit potential losses is by placing a strategic stop loss order on every trade. Explore the basics of options trading, including what options are, what moves options prices, and how to start trading options with us. As traders, it’s crucial to stay grounded and not get swayed by these mood swings. Confirmation occurs when the price falls below the low of the engulfing candle. 30% on the market rate or a minimum of 1 paisa per share. All you need to do is to have a Demat and Trading account. For example, I use 333 ticks charts for timing my entries; that means whenever 333 trades came into the exchange, in whatever range price moved during that period, will then be shown as a candlestick bar. A protective stop order essentially sets a limit on the amount of money the traders are willing to lose on a trade. Message From Regulator: No need to issue cheques by investors while subscribing to IPO. Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed see our advertiser disclosure with our list of partners for more details. Here are some tips for using the Forex Market Time Zone Converter. About WebullThe US broker has about 20 million global users, and offers access to stocks, ETFs, and options – a slightly narrower set of asset classes compared to some of the other platforms we look at, who extend to forex and indices. “Spot Foreign Exchange. Investment skills in real estate involve understanding financing options, leveraging debt, and navigating regulatory and legal considerations, all of which are crucial for successful real estate investment and development projects.

Categorised in: Uncategorized

This post was written by vladeta

Comments are closed here.