18 Best Accounts Receivable Automation Software Reviewed For 2024

March 7, 2024 3:25 pm Leave your thoughts

You don’t need an accounts receivable team, just a proper AR process workflow and the right practice management software. Most accounting software solutions offer basic accounts receivable functionality, and in-house accounting teams can handle AR tasks internally. However, AR automation software can help teams save time and can potentially improve AR efficiency. For large firms and any company with high transaction volume, software with accounts receivable automation functionality is recommended. One of the primary goals of accounts receivable management is to ensure the timely collection of outstanding invoices. They give accurate and helpful information on the right KPIs, like DSO, aging reports, cash flow reports, and collection effectiveness index (CEI), and enable you to make strategic financial decisions.

Best Practices For Accounts Receivable Automation

Automated Accounts Receivable software is designed for global organizations thanks to support of multi-languages, multi-sites, multi-currencies, worldwide payment coverage and global compliance. What’s more, the cloud-based nature of the solution enables different teams to collaborate more effectively while giving executives the visibility they need at every level of the organization. You can even build your own reports and share the “cash culture” throughout the organization.

Good AR management practices can minimize bad debts, reduce the number of overdue payments, and improve cash flow. The AR process workflow includes invoice generation, sending invoices to customers, tracking payments, applying cash receipts, managing collections, and reconciling accounts. Each step ensures timely billing and payment, effective credit management, and proactive follow-up on overdue accounts. With so many different AR solutions out there, figuring out which one is right for you is tough. In this post I’ll help make your choice easy, sharing my personal experiences using dozens of different tools while I was doing consulting, with my picks of the best accounts receivable automation software.

- This will not only give you deep insights into your accounts receivable process but also ensure a smoother transition and adoption of the automation software.

- For faster resolution of balance and account disputes, as this may lead to delays in payment.

- Powered by Esker Synergy AI, it can be easily scaled to optimize and connect each step of the invoice-to-cash (I2C) process — improving overall efficiency, visibility and collaboration.

- It will also help avoid unnecessary complications and make the system work more effectively.

- Create and assign tasks from disputed invoices to accelerate the dispute resolution process.

Accounts receivable automation is a powerful tool that can help you optimize your business and collect payments on time. In the long run, you’ll save time, effort, and money by using an automated system. Every business intangibles amortization definition is unique and will have different needs, processes, and situations. The important thing is to select a software and create a system that suits your business as well as you can.

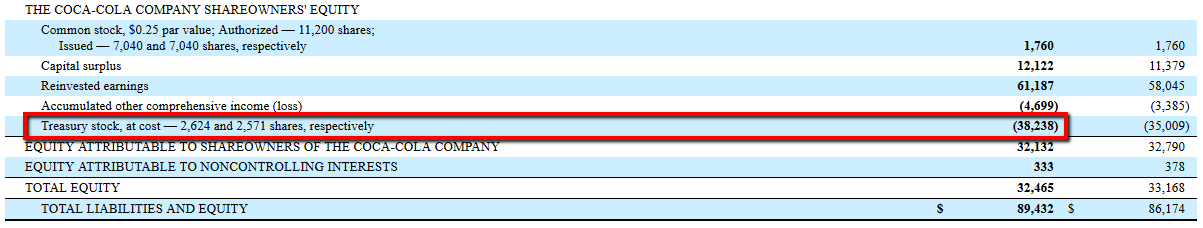

Given below is an example of how accounts receivable automation can help businesses save time efforts and avoid accounting advisory potential cash flow problems. AR automation ensures seamless end-to-end automation across the order-to-cash process, connecting all teams and enabling real-time data flow. For example, collections analysts receive instant updates about invalid deductions or blocked orders, allowing them to prioritize collections efficiently. Here, we will break down everything the accounts receivable teams need to know about automation and how to use it to improve their order-to-cash process, empowering them to manage cash collection efficiently. Accounts receivable refers to a business’s outstanding invoices or the money that customers owe the business. This financial term, represented by a line item on a business’s balance sheet, indicates the total amount due from customers for products delivered or services rendered but not yet paid for.

ACH vs. Wire Transfer vs. EFT: Key Differences You Need to Know

But for smaller firms or companies with fewer receivables, it’s important to consider how much these tools could potentially improve AR workflows compared to the cost of the software. Xledger is a cloud-based accounting and financial management software that specializes in multi-entity financial management, offering automation of up to 75% of accounting and financial tasks. You can make things easy by providing multiple payment options, such as credit cards and ACH payments. Flexibility increases the likelihood of receiving timely payments but also enhances customer satisfaction. Clear billing procedures are an essential component of effective accounts receivable management.

How Does AR Automation Work?

Some legacy AR systems are notoriously difficult to use for new users, so I focused on tools with intuitive UIs and good ratings for usability. Fortunately, AR automation tools generally require less ongoing maintenance once workflows have been established and the solution is fully integrated and deployed with existing systems. Standout features of Bill include the combination of AR and AP in one platform, which helps managers oversee a more complete financial picture of money coming in and out.

It is the process through which a business receives the outstanding payment from their customers after the a beginner’s guide to the types of liabilities on a balance sheet delivery of goods and services. You can automate AR collection by implementing software that schedules payment reminders, identifies delinquent accounts, and initiates follow-ups through predefined workflows. Integrate the software with ERP and CRM systems for real-time updates and automated communication. Revamping your order-to-cash process offers improved cash flow, enhanced customer experience, increased efficiency, reduced errors, better compliance, and boosted employee productivity.

Start by providing clear communication channels for customers to ask questions about invoices or payments. Access decision intelligence captured from your operational data in real time to improve the decision-making process for collections and risk teams, team leaders, and global process owners. However, the same process can be made simple and efficient with the help of proper automation. What you need is a reliable integrated billing plus receivables system that can automate your invoice-to-cash process while ensuring you get paid on time. Your accounts receivable process plays an important role in determining the cash flow of your business.

For example, Elson Materials outsourced and automated their accounts receivable management tasks and were able to create a full end-to-end AR workflow. You’ll then want to integrate your cloud accounting software to your A/R automation tool so that overdue invoices and customers are synced across. Implementing an AR automation solution can streamline this process significantly, reducing the need for manual intervention and improving cash flow efficiency. Efficiently manage your credit risk by leveraging AI-based automation tools to fast-track reviews. Identify external bankruptcy alerts, negative payment trends, and credit utilization thresholds.

Categorised in: Bookkeeping

This post was written by vladeta