As to the reasons gets the Assist financial become lead?

January 18, 2025 10:33 am Leave your thoughtsFirst-day people is offered 100 % mortgages of the UK’s biggest lender while the latest put-totally free financial attacks the business.

Lloyds Bank’s Lend a hand financial allows very first-day customers in the England and you can Wales to acquire a house costing around ?five hundred,000 in the place of a deposit.

This new financing talks about ranging from 95 and you will 100 percent from the price out of an initial house. not, consumers will demand a close relative which have good-sized coupons so you can stump right up ten % of the house rate due to the fact defense inside buy to get into this new 100 percent mortgage.

It currency will go into the a three-season fixed-identity savings account generating 2.5 percent attention, which will be repaid after the term however, can not be accessed in advance of one. In the event your consumer misses one mortgage payments this type of would be subtracted on offers.

Toward mediocre very first-date buyer today getting down a deposit away from ?110,182 inside the London and ?33,211 regarding remaining portion of the country, increasing a lump sum is just one of the greatest hurdles so you can bringing into the property steps.

First-time customers what you need to see when selecting the first home

Predicated on a good Lloyds poll, half of ambitious earliest-go out consumers told you increasing a deposit are the greatest test when trying get a house.

An average of, 18-thirty-five 12 months olds is protecting ? per month, meaning it can take all of them 15 years to store to possess an effective deposit, otherwise 52 age during the London.

“The item was helping target the biggest difficulties basic-go out people deal with to getting about the property ladder, while rewarding loyal consumers into the the lowest-speed environment,” said Vim Maru, class director, retail at the Lloyds Financial Category.

The way the Assist financial performs

This new Lend a hand home loan ‘s the current greatest purchase having both customers and savers. Its repaired on dos.99 per cent interest for three many years, that’s 0.1 percent below brand new likewise prepared Family relations Springboard financial out-of Barclays.

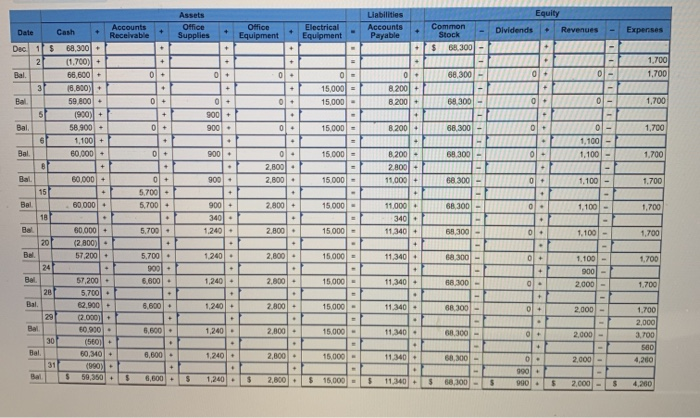

- Family rates: ?425,030

- Monthly payments at the about three-seasons repaired rate away from dos.99 %: ?dos,

- Monthly premiums towards the Lloyds fundamental variable rate from cuatro.24 per cent immediately following 36 months: +? = ?dos, (to possess remaining twenty-two many years)

The two.5 percent discounts rate on the Lloyds home loan was slightly greater than new Barclays you to, which is guaranteed to end up being 1.5 per cent above bank foot rates for three ages. Currently that establishes brand new Barclays coupons interest from the dos.25 percent, although this you can expect to go up otherwise slide based on what will happen in order to rates.

The latest Barclays Family Springboard home loan also has a maximum title off 25 years, since the Lloyds home loan is going to be removed for 31, making month-to-month money straight down – although this carry out improve total quantity of interest reduced more than the category of one’s mortgage.

In place of other similar schemes, the latest Lloyds financial is fairly flexible about what members of the family is also lead first-big date consumers get help from their college students, siblings, grand-parents otherwise aunts and uncles.

Sometimes the customer otherwise loved one must be a bar Lloyds Most recent Membership manager, that has an excellent ?step 3 fee every month, unless of course ?1,five-hundred are paid-in each month.

What is the catch?

What ‘100 % mortgage’ try bound to band alarm bells for a few people, cautious about a come back to the sort of financing viewed throughout that time leading up to the brand new economic crash.

The fresh device is nearly a re-run of 100 per cent-together with money offered from inside the 2008, because of the importance of the brand new 10 percent lump sum so you can back it up. However, there are numerous considerations people is always to keep in mind just before taking out fully eg a giant mortgage, particularly in the present day property id Brexit-uncertainty.

Family costs are anticipate to keep broadly apartment along the 2nd three years in order to fall in London area this year.

In the event the home costs stay at the current peak, consumers trying out it 30-year mortgage tend to nevertheless you desire a great 93.5 % loan so you can value financial in the event the around three-season fixed identity is right up during the 2022, claims Andrew Hagger out of .

In the event the cherished one chooses to take back their ten for every single cent up until now it may be burdensome for the consumer so you’re able to remortgage, pressuring the consumer on the Lloyds basic adjustable rates.

“Just what remains to be seen are definitely the possibilities to individuals if three year repaired rate has ended. Being left having including a leading mortgage to help you worth contribution is always to ensure it is borrowers in order to lso are-mortgage somewhere else though alternatives will be very minimal,” says Colin Payne, https://paydayloanflorida.net/venice/ member director from Chapelgate Private Money.

“At the present time, a borrower aspiring to re-home loan at this financing to help you worth is considering similar costs so you’re able to Lloyds Bank’s three-year fixed rate from dos.99 percent.

“Lloyds Bank has told you it does give choices to individuals in the event the repaired price expires, not, these usually clearly become in accordance with the financing so you’re able to well worth from the enough time of course, if possessions opinions provides dropped the fresh costs to your promote was impractical become since the attractive once the brand-new words.”

From inside the a terrible situation condition, in the event the household pricing fall in the second three years – not hopeless because of the most recent number of Brexit suspicion – upcoming customers might end upwards from inside the bad guarantee, incapable of remortgage otherwise flow and you may caught up on Lloyds’ basic adjustable price.

This means they are able to benefit from the stamp obligations decreases readily available to help you earliest-time consumers, that is not possible if someone else who may have previously owned a possessions enjoys their name with the deeds also like when the to find together with a pops the master of the home.

Signup all of our area where you could: comment on stories; donate to newsletters; go into competitions and availableness blogs for the all of our application.

Categorised in: cash advance america loan

This post was written by vladeta