Bringing a normal Financing, Zero Assessment Requisite

November 11, 2024 1:02 pm Leave your thoughtsAppraisals assist make sure you aren’t overpaying when purchasing a property, although they include an installment and slow down to help you closing.

When you find yourself selecting a conventional financing no assessment called for, you might be fortunate: Fannie mae and you can Freddie Mac one another promote appraisal waivers into the purchase and refinance fund in some situations.

Advantages of Conventional Money without Appraisal

This is often to avoid paying assessment will set you back. Considering an excellent 2022 data by the National Relationship from Real estate agents, the fresh average family appraisal commission is $500. Their research unearthed that 71% out-of appraisals prices $eight hundred or more, and you will nearly ten% manage significantly more than $800.

Different varieties of Appraisals

Antique Appraisal A vintage assessment pertains to a licensed otherwise specialized property appraiser seeing the home and you may inspecting the interior and you will additional. The new appraiser up coming scientific studies current local possessions transformation to help you estimate a beneficial fair market value with the domestic.

Desktop Appraisal Desktop computer appraisals are completed because of the a licensed otherwise certified assets appraiser. But rather out-of requiring a call at-individual domestic inspection, the newest appraiser performs its search on the web according to publicly offered and you can option study source.

Assessment Waiver Fannie mae otherwise Freddie Mac’s automated underwriting program establishes one to an appraisal is not needed. This might be both called property review waiver, or PIW.

From inside the COVID-19 pandemic, old-fashioned loan providers welcome appraisers doing “drive-by” appraisals, hence didn’t are an out in-people evaluation of home’s indoor. Since , Fannie mae no further accepted such additional-merely monitors.

Freddie Mac computer direction still accommodate additional-only appraisals in certain situations, although many https://availableloan.net/personal-loans-nh/ loan providers could possibly get choose for a classic assessment instead.

Who is Entitled to a zero-Assessment Old-fashioned Financial?

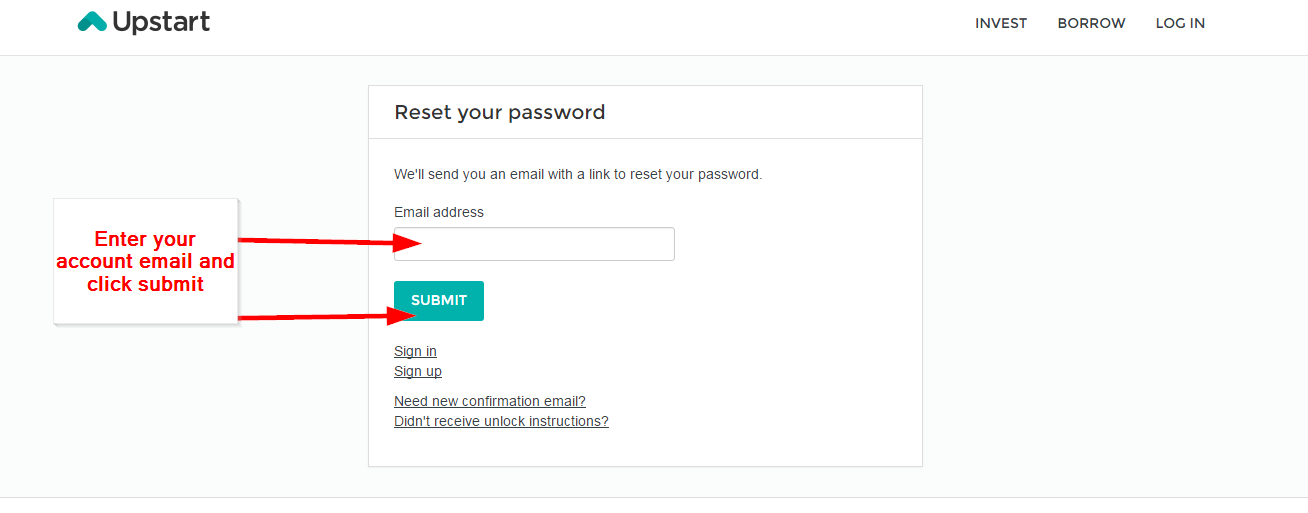

![]()

With respect to old-fashioned financing, this new lender’s automated underwriting program find which or no from assessment is necessary.

There are many activities the program assesses, along with facts about your own borrowing character and you will financial certificates, in addition to information on the house or property by itself.

The fresh new purchases most likely for good waiver are consumers with higher credit ratings, a substantial deposit (or existing security getting refinances), extra property, or any other circumstances appearing the lowest-chance financing.

The computer likewise has use of a databases from early in the day appraisals. In case the assets has received an excellent valuation before couples years, the device might waive the necessity for a special appraisal.

You are, however, less inclined to be able to waive an assessment inside outlying portion or areas where property are different in size and you can age due so you’re able to less reliable possessions study.

Particular Conventional Mortgage loans That will Located An assessment Waiver

Antique loans in the place of an assessment are offered for buy and you will re-finance deals if automatic underwriter program deems the transaction qualified. Because it is according to an enthusiastic undisclosed algorithm, it is extremely difficult so you can assume when a property gets a good waiver.

Properties have to be solitary-unit to help you meet the requirements, which includes condos. Number 1 houses and you will 2nd belongings meet the requirements both for Fannie mae and Freddie Mac. Fannie mae, but not, has the benefit of with no-appraisal refinances to your investment services.

If you’re looking to own a finances-out re-finance and want to avoid an assessment, you should explore a loan provider who works with Fannie mae. Freddie Mac’s zero-appraisal applications do not allow borrowers to receive cash back within closing.

Guidelines also are specific on whenever appraisal waivers are not available. Some of the services and you can purchases that aren’t qualified to receive an assessment waiver are:

Note: Freshly created attributes that have an existing assessment to the document may be eligible. This will be away from a previous buy agreement that were not successful to shut.

There are other lesser differences when considering Fannie mae and you may Freddie Mac concerning your conditions due to their no-assessment home loan apps:

Categorised in: how do you do a cash advance

This post was written by vladeta