Cost of Goods Sold: Defining & Calculating COGS

October 19, 2022 4:41 pm Leave your thoughts

In other words, divide the total cost of goods purchased in a year by the total number of items purchased in the same year. For example, a plumber offers plumbing services but may also have inventory on hand to sell, such as spare parts or pipes. To calculate COGS, the plumber has to combine both the cost of labor and the cost of each part involved in the service. You will understand the formula and know how to calculate the cost of goods sold during the period for your own company and the principle behind the formula. Assuming that prices rose from January to June, Shane would have paid more for the June inventory and LIFO would increase his costs and decrease his net income relative to FIFO. A declining Gross Margin, resulting from a rising COGS / Revenue ratio, suggests that the company might be facing challenges in managing its direct costs.

How Do You Calculate Cost of Goods Sold (COGS)?

In these cases, comprehensive cost accounting methods that can allocate overhead and administrative costs more accurately are more informative. Since COGS does not account for all operating expenses, the gross profit (revenue minus COGS) might give an inflated view of profitability. As soon as something is sold, it is removed from the system keeping a real time count of inventory. Using a perpetual system, Shane would be able to keep more accurate records of his merchandise and produce an income statement at any point during the period.

Other BIWS Courses Include:

The cost of sending the cars to dealerships and the cost of the labor used to sell the car would be excluded. Our finance data platform has made it easy to offset reversals without having to pull data from disparate data sources. And you can see all of the onsets and offsets of a single customer or a single record all in one place, which is not the case for most companies.

Statement of Manufacturing Companies:

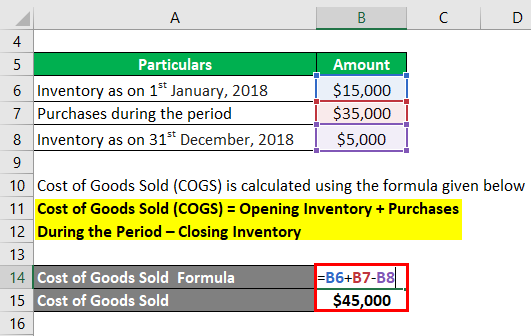

Here in our example, we assume a gross margin of 80.0%, which we’ll multiply by the revenue amount of $100 million to get $80 million as our gross profit. Generally speaking, COGS will grow alongside revenue because theoretically, the more products and services sold, the more must be spent for production. As another industry-specific example, COGS for SaaS companies could include hosting fees and third-party APIs integrated directly into the selling process. In this case, since the operations were only started during the current year, there will be no opening inventory of the company. Thus, the same will be taken as zero while calculating the cost of goods sold. Inventory at the beginning of the calendar year, recorded on January 1st, 2018, is $11,000, and the Inventory at the end of the calendar year, recorded on December 31st, 2018, is $3,000.

COGS are the direct costs tied to the production of goods, which are almost always variable in nature. COGS influences key financial indicators ranging from pricing to profit margins and factors into analyses like the breakeven formula directly. Companies that make and sell products or buy and resell goods must calculate COGS to write off the expense. The resulting information will have an impact on the business tax position.

Inventory costing methods

This is because the oldest costs are considered and are matched with the current revenues, so this can lead to misleading profit figures. In this example, Harbour Manufacturers uses the perpetual inventory system and FIFO method to calculate the cost of ending inventory and COGS. This means, physical periodic verification of the inventory records is required. The physically counted inventory is then compared with the recorded inventory and is corrected to match with the quantity that is actually on hand. It is important to note that under the periodic inventory system, the inventory left at the end of the year (closing inventory) is counted physically.

The IRS requires businesses that produce, purchase, or sell merchandise for income to calculate the cost of their inventory. Depending on the business’s size, type of business license, and inventory valuation, the IRS may require a specific inventory costing method. Cost of goods sold (COGS) is calculated by adding up the various direct costs required to generate a company’s revenues.

- Cost of Goods Sold (COGS), otherwise known as the “cost of sales”, refers to the direct costs incurred by a company while selling its goods or services.

- Gross profit also helps to determine gross profit margin, a percentage that indicates the financial health of your business.

- Gross margin is an important metric that often involves operations, procurement, supply chain, and sales teams because of the significant impact of COGS on a company’s performance.

- However, this formula is most effective when inventory is the bulk of COGS.

- You will understand the formula and know how to calculate the cost of goods sold during the period for your own company and the principle behind the formula.

We know that there is consumer demand so how do we improve our margins? Should we increase marketing efforts and focus on pushing higher-margin products? We’re getting better rates from our vendors so what if we promote the newer arrivals first so that we can sell the products with the lower cost first (assuming a FIFO inventory method)? Let’s chat with marketing regarding new campaigns and with supply chain to ensure we can handle the added shipping volume without excessive delays in light of the pandemic. In accordance with the matching principle and accrual basis of accounting, COGS should be recorded in the same period as the revenue it generated. ASC 606 requires companies to apply the 5-step revenue recognition principle to transactions with customers and directs companies to recognize revenue when earned.

Instead, COGS is reported on the income statement and directly affects the inventory figures which are shown on the balance sheet. The balance sheet reflects the ending inventory, which is directly influenced by the COGS calculation. If you’re a manufacturer, you need to have an understanding of your cost of goods sold, and how to calculate it, in order to determine if your business is profitable. Here are the five steps for calculating COGS, then fill in our Cost of Goods Sold Calculator with your own data. More than that, the costs assist users in assessing the margin that the company could earn from the products by comparing the company’s expectations, competitors, and industry averages. ABC Company, trading company, the end of its financial year is on 31 December.

COGS includes only the direct costs of producing goods, such as raw materials and direct labor. This focus excludes indirect costs like overhead, administrative expenses, and marketing costs. While this provides clarity on the direct profitability of products, it omits significant expenses that can affect the overall profitability of the company. It should be taken as an expense while analyzing that accounting period. The cost of the goods sold is matched with revenues earned from selling the goods, thereby considering the gross profit. The cost of the goods sold is matched with revenues earned from selling the goods, thereby considering the matching principle of the accounting.

Finally, the business’s inventory value subtracts from the beginning value and costs. This will provide the e-commerce site with the exact cost of goods sold for its business. Therefore, a business needs to determine the value of its inventory accounting basics for an llc at the beginning and end of every tax year. Its end-of-year value is subtracted from its start-of-year value to find the COGS. In the final step, we subtract revenue from gross profit to arrive at – $20 million as our COGS figure.

Categorised in: Bookkeeping

This post was written by vladeta