Equity Funds against. Non-Guarantee Financing: An evaluation from Can cost you and you will Attention

January 21, 2025 5:26 am Leave your thoughtsNon-collateral money, known as unsecured loans, offer several benefits to help you individuals compared to old-fashioned secured loans. Here are a few good reason why a non-security mortgage might be the correct require you:

- Zero Equity Necessary: The greatest advantageous asset of low-equity money is that you don’t have to exposure your rewarding property, like your house, car, otherwise organization products. This will make this type of finance an attractive choice for consumers exactly who may n’t have extreme property so you’re able to pledge or that simply don’t need to lay their residence on the line.

- Much easier and you can Faster Recognition: Just like the lenders won’t need to see and you will verify guarantee, the application form and you can recognition techniques getting low-equity financing is generally reduced and sleek than for safeguarded loans. This is for example beneficial if you like funding easily.

- Higher Freedom: Non-equity money often support a more versatile entry to loans. You can utilize the bucks for a variety of company or private expenses with no constraints that can have secured personal loans.

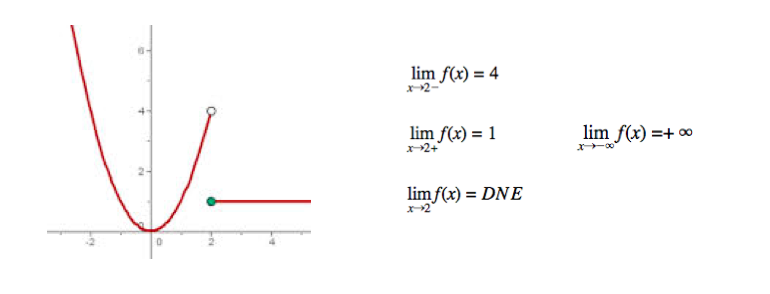

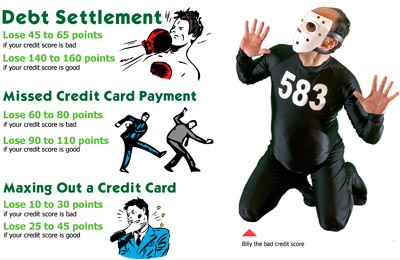

- Create Credit score: Paying off a low-guarantee financing responsibly makes it possible to introduce otherwise replace your borrowing from the bank score. This demonstrates to coming loan providers your a reliable debtor, possibly causing greatest prices and you will terms toward upcoming funds.

- Less Payment Terms and conditions: If you are shorter payment terms and conditions can also be set even more instant pressure on the finances, they may be able also be advantageous. You can pay back the mortgage quicker, probably spending less to your notice along side longevity of the mortgage.

Drawbacks from Non-collateral finance

- Highest Interest rates: As you mentioned, loan providers look at low-collateral financing just like the riskier because they don’t have any house to seize for many who default towards the loan. That it means high interest rates to compensate on the increased risk.

- Stricter Certification Criteria: Loan providers have a tendency to scrutinise your creditworthiness very carefully. You’ll likely need a good credit score and you will a solid earnings records in order to be considered.

- Potential Personal Responsibility: Specific non-security fund may require a personal verify. Thus if for example the organization is struggling to pay off the newest loan, you become personally responsible for the debt, probably putting your own property https://paydayloansconnecticut.com/glenville/ at stake.

- Quicker Repayment Terms and conditions: Non-guarantee funds usually have quicker installment terms than the secured finance. This can mean large monthly payments, that could put a-strain on the businesses earnings.

Rates of interest try a big deal, as well as in Singapore, they’re quite additional dependent on whether or not you get a good collateral loan (having some thing valuable since protection) or a non-security mortgage (no defense needed).

Interest rates: Lower that have Collateral

Fundamentally, guarantee money include reduced rates of interest, possibly only step 1% in order to dos%. The reason being the financial institution has actually your house otherwise automobile because the a back up if you’re unable to pay back.

Non-equity money, on top of that, can have rates of interest any where from step three% in order to a whopping ten% or maybe more! So, if you’d like to save well on interest, a security financing could be the strategy to use.

Past Interest levels: The true Cost

But wait, interest levels commonly the complete tale. The fresh new Active Interest rate (EIR) is another important said. This amount items throughout the excess charge the mortgage you will enjoys, particularly processing fees or administrative costs. It offers a better image of the full rates you’ll incur.

Charge adds up.

Right here is the procedure: both collateral and you may non-security loans have additional fees. Security funds might require a whole lot more documentation and take offered so you’re able to procedure, which can increase the cost. In addition, security funds could have highest upfront charge.

The most suitable choice hinges on your position. Shop around and you will examine lenders to discover the financing with the lower overall cost for you and the funding that you need to have.

Categorised in: american payday cash advance

This post was written by vladeta