FHA and USDA fund you prefer particular documents getting acceptance, such as a keen ID, shell out stubs, and you can tax returns

November 1, 2024 7:35 am Leave your thoughtsWhenever you are faced with the decision out of whether or not to match a USDA financing or an FHA loan, it does commonly feel a hard solutions. While some of the conditions may convergence, you will find key variations that put all of them other than one another.

In order to understand the differences finest, browse the table offered below. It features one particular issues you have to know when you compare USDA against. FHA finance.

Let us speak about the new specifics of several points and you may know items whenever one to loan kind of will be a great deal more advantageous compared to the other.

Home loan Recognition Process

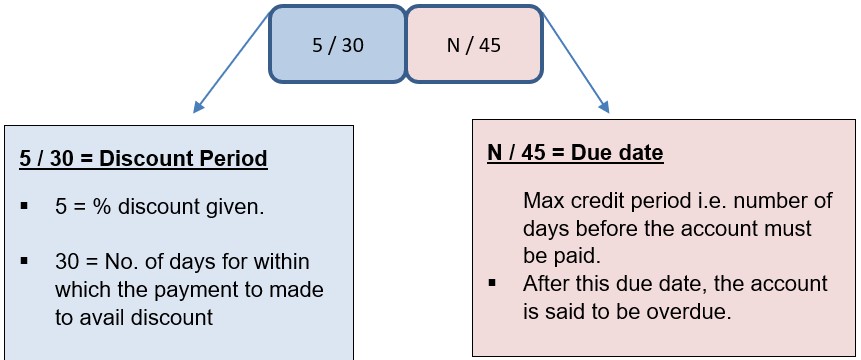

Thought delivering mortgage pre-approval for the FHA otherwise USDA mortgage so you can speed up the new techniques. Even after preapproval, it might take 29 so you’re able to forty-five weeks to get rid of the borrowed funds and you may romantic on the house.

This new USDA home loan processes might be longer than a keen FHA mortgage because the USDA fund experience double underwriting-earliest by the financial then of the USDA.

Your house have to proceed through an appraisal by both USDA and you can FHA to ensure you will be expenses a good rates, however, USDA loans skip the household assessment action .

FHA money include her gang of criteria that may extend brand new timeline. The financial will demand an assessment and check out of an FHA-recognized appraiser in advance of closing.

After you romantic, you’re likely to move into your house within this 60 days and you may live there as your fundamental residence for at least a-year. Failing to see such conditions can lead to legalities.

USDA and you will FHA financing should let borrowers who will get view it challenging to meet with the down payment you’ll need for typical loans. USDA finance dont need a deposit. not, if you make a deposit , you will most certainly reduce your month-to-month mortgage payments additionally the rate of interest towards the financing.

To possess an FHA mortgage, which have a credit score ranging from five-hundred to help you 579, a downpayment of at least 10% of one’s residence’s price required. If the credit score is actually 580 or higher, FHA mandates a minimum step 3.5% downpayment. Just like USDA financing, a larger deposit can result in https://paydayloanflorida.net/davenport/ all the way down interest levels and monthly mortgage payments .

Home loan Insurance policies

Home loan insurance is included when you submit an application for possibly a keen FHA or an effective USDA mortgage. not, extent you pay for mortgage insurance rates may differ considering the application you decide on.

To own FHA funds, the mortgage insurance premiums was high than the USDA finance, specifically if you build a smaller sized downpayment. For folks who deposit the minimum step three.5%, their monthly financial advanced would-be 0.85% of your amount borrowed. So it superior must be paid down regarding entire financial term, in addition to the upfront percentage of just one.75%.

Off USDA financing, the required superior, known as the financing commission, dont meet or exceed 0.5% of your own left harmony and step 3.75% initial. You will be required to spend the money for monthly advanced towards entire term of the USDA mortgage.

Income Requirements

If you’re considering an FHA mortgage, your income isn’t really a determining foundation. There aren’t any specific money limits, however you must demonstrated a reliable money that shelter your own loan. Typically, you’re going to have to tell you tax returns, shell out stubs, and you may performs verification when you look at the app procedure.

On USDA loan program, you can find earnings constraints. Your earnings cannot go beyond 115% of the average money on the part. Due to the fact lifestyle will cost you and wages disagree across the says, certain parts succeed highest income thresholds. You can guarantee the qualifications considering your local area through the USDA’s webpages.

Categorised in: cash advance on a loan

This post was written by vladeta