How exactly to Submit an application for A Va Financing: 6 Tips

January 24, 2025 3:49 am Leave your thoughtsAssets Tax Exception to this rule

Possessions fees money things like libraries, flames divisions, and you will local road and you can creativity plans. Handicapped veterans’ property taxation exemptions normally reduce steadily the number you must shell out during the property taxes.

This type of tax exemptions aren’t a federal system, and so they www.availableloan.net/installment-loans-nm are very different by condition, therefore consult your regional Virtual assistant place of work to understand new exemptions you may be eligible for. Particular says promote a different to veterans, whenever you are most other says limitation that it advantage to experts that are already acquiring handicap costs. Handicapped experts is 100% excused of property taxes in certain says.

Obtaining a good Virtual assistant mortgage is similar to applying for virtually any mortgage in lots of respects. Capture these types of 6 procedures into account when applying.

step one. Secure a certificate regarding Qualifications (COE)

Needed this getting entitled to your Virtual assistant financing. You will have to offer proof of your army service based on their standing.

Tell your mortgage broker you desire your certificate from qualification early in the act for them to help you to get it.

dos. Get Preapproved

When selecting a house, rating preapproved in the beginning. The brand new approval will give you a baseline getting determining simply how much you really can afford. On top of that, after you generate an offer for the a home, you can find sellers tend to capture also provides alot more positively if an excellent letter of preapproval was connected.

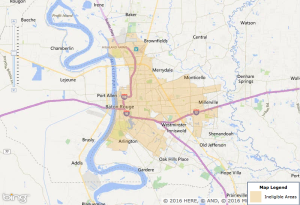

step three. Look for a house

In search of a property which have an excellent Virtual assistant loan feels as though in search of a great home with almost every other mortgage choice. Any type of possessions you get need to meet with the VA’s Lowest Possessions Conditions, or MPRs. MPRs guarantee the residence is safe, structurally sound and you can sanitary. These types of conditions will vary based on known threats in a location.

Once you look for property you love on the price range, installed an offer to buy the house. The vendor can get undertake their provide, reject the offer otherwise counteroffer. When you together with supplier acknowledge a cost, a representative or lawyer can help draw up a beneficial transformation offer.

5. Experience Va Assessment and Underwriting

Underwriters usually determine your money and make certain you qualify for good Va financing. The fresh new Va might require an appraisal ahead of it approve new financing. Virtual assistant appraisals is more strict than simply conventional fund. Throughout an effective Virtual assistant assessment, the appraiser commonly make sure that the home fits the brand new VA’s MPRs and that’s hygienic, structurally sound and you can disperse-in the able with reduced fixes.

6. Romantic on your Brand new home

Because the Virtual assistant appraiser says your residence is as well as sound, it’s the perfect time about how to sign up the new home, ensure you get your loan and receive the secrets to your assets.

The bottom line: Is actually A good Virtual assistant Mortgage Most effective for you?

A great Virtual assistant loan is an important work with won because of the all of our army. If you meet the requirements, you should buy a great interest rate no money off, even if you features previous borrowing from the bank dilemmas. If you were to think such you’re able, sign up for an effective Va financing that have Complex Resource now!

National Protect equipment get into private claims, so there is not any main record archive. Contact the latest National Shield Adjutant General’s Office about county in which you served and request your own NGB Function 22 and you can 23 so you can get your COE.

Don’t be concerned, in the event. More often than not, if you don’t have the cash at the start, the brand new Va financing payment are rolling into the financial.

Disabled veterans may be eligible for a short-term Household Variation (TRA) grant to provide adjustment into the property which make it simpler to help you navigate if you reside with a member of family. Eg SAH features, it’s not necessary to repay their TRA grant, leading them to a strong tool for pros which have versatility-relevant disabilities.

Categorised in: get cash payday loan loan

This post was written by vladeta