How much cash away from home financing Should i Get That have an excellent 650 Credit rating?

January 31, 2025 8:53 pm Leave your thoughtsIf you an effective 650 credit score, its absolute so you can question whether now could be a good time to help you get a mortgage or if or not boosting your credit rating earliest try ideal. Fortunately? You might qualify for various kinds mortgages which have a good 650 credit history. The fresh new not so great news? You can pay a high interest rate than someone which have a great a beneficial otherwise decent rating. Keep reading to respond to, “Exactly how much of a mortgage do i need to rating with an effective 650 credit history?” for the problem.

- 650 Credit rating: Is it A or Bad?

- Why does Your credit score Impact the Quantity of Mortgage You can buy?

- Simply how much Money Might you Rating having home financing That have an effective Credit score off 650?

- Pick All the sixteen Situations

650 Credit history: Would it be A or Bad?

The most popular credit history model, the fresh new FICO score, selections off three hundred to help you 850. A credit history of 800 to 850 try exceptional, when you find yourself a score out-of 579 or shorter represents terrible. In the middle, a credit rating off 670 so you can 739 was categorized nearly as good, whenever you are ratings one are priced between 580 and you can 669 are considered fair. Sixty-eight % out of Us citizens enjoys fico scores of good or maybe more, hence is you, too.

A credit rating out of 650 is within the high end out of the fresh fair personal loan with no acusition fee assortment. Which have really works repaying financial obligation, to be an authorized user or having a lease revealing business, you’re in a position to improve credit history on an effective range.

How does Your credit score Change the Level of Mortgage You can get?

Whenever loan providers agree your loan application, they appear in the products for example full obligations, debt-to-earnings proportion, your credit rating and you may credit history. Each one of these make a difference to maximum mortgage acceptance amount and mortgage conditions. That have a higher credit score, you could potentially be eligible for a more impressive mortgage, straight down interest or even more advantageous cost terms and conditions.

Just how much Capital Do you really Get getting home financing Having good Credit history away from 650?

Though some loan providers reject a mortgage software when you have good 650 credit score, you could potentially qualify for a normal home loan or financing supported from the Federal Houses Government (FHA), Pros Items (VA) or You.S. Department of Farming (USDA) financing with that get.

Old-fashioned Mortgage

You might be eligible for a normal financing with a credit score from 620 or maybe more, thus a beneficial 650 credit history is enough for those who meet brand new lender’s most other requirements. Exactly how much money you can get is dependent upon your revenue, personal debt, debt-to-income proportion or other things including the advance payment amount. Which have a high earnings, straight down debt-to-earnings ratio, and you may advance payment from 20% or higher, you might be eligible for more substantial conventional mortgage.

For people who submit an application for a conventional conforming mortgage, the utmost loan amount in the most common of one’s You.S. are $766,550, having higher constraints in some large-prices areas.

FHA Mortgage

Government-supported FHA fund want a minimum credit rating regarding 500 to 580. You’ll need a credit history of at least 580 so you’re able to safe the loan with just a great step three.5% down payment. The complete approved amount borrowed may vary by the personal things. The Department away from Construction and you can Urban Development’s limits to have unmarried-home loan numbers inside 2024 vary from $498,257 so you can $1,15 million.

USDA Mortgage

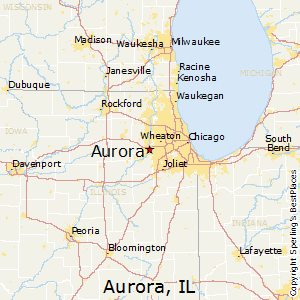

USDA finance is an alternative regulators-supported mortgage choice. The lending company would need to create an entire credit comment if the your credit rating are lower than 640, therefore which have a credit score away from 650, you need to be capable be considered for many who meet almost every other criteria. So you can be eligible for new USDA mortgage program, you need to satisfy limit earnings conditions and buy a property during the a being qualified rural area. USDA restriction mortgage limits are very different because of the town however they are $377,600 in the most common of the nation.

Va Loan

Va fund, supplied by the newest Agency of Experts Factors, are around for productive and you will experienced armed forces professionals as well as their spouses. With regards to the Virtual assistant, there’s absolutely no lowest credit rating requirements, but many Virtual assistant lenders need a credit rating with a minimum of 620. A 650 credit score is going to be sufficient to qualify for a great Va home loan for those who meet the most other Virtual assistant loan requirements, in addition to service requirements.

Exactly what Other factors Impact Your own Mortgage Costs?

Rates of interest generally changes, even so they have has just be more erratic in the modern industry. Whilst you try not to myself control the market industry speed, you will find things within your handle that change the particular off financial you are able to qualify for.

1. Latest Obligations Membership – A high credit history and you will money will not make sure approval for financing; lenders contemplate the debt-to-money proportion. Which ratio shows good borrower’s power to would loans, and you can a lesser ratio is far more favorable. Borrowers should become aware of the DTI and you can work at reducing debt or expanding earnings adjust their likelihood of financing recognition.

2. Downpayment – Down payments will help beat a good lender’s chance giving a sense of defense whether your borrower defaults on financing. When a borrower leaves down a large amount of money initial, he has got even more committed to the home or resource, leading them to less likely to disappear off their financial commitment. So it reduces the likelihood of the lending company losing money in the enjoy out of a standard. Brand new deposit as well as acts as a speech of your own borrower’s monetary stability and you may capacity to conserve, that may next assures the lender towards borrower’s capability to pay back the borrowed funds. Sooner or later, down repayments act as a safety scale having lenders facing possible losses.

step three. Level of Earnings – In terms of making an application for a home loan, your earnings takes on a vital role inside the deciding the level of money that loan providers are prepared to give for you. Lenders typically conform to a guideline you to claims your monthly casing expenditures shouldn’t exceed twenty eight% of one’s gross month-to-month earnings. This is why the higher your revenue, the better the borrowed funds matter it is possible to be eligible for.

Categorised in: how to get a payday loan with bad credit?

This post was written by vladeta