How to assess payment earnings for home financing

February 4, 2025 2:23 am Leave your thoughtsIncome certification the most important factors when implementing getting home financing – therefore understanding how lenders determine your revenue are going to be crucial.

The good news is, simply because you are thinking-working otherwise a payment-centered earner, does not mean you can not be eligible for home financing. It simply setting you’ll know exactly how loan providers look at the income so you can establish up for achievement.

- Calculating payment income

- Mortgage standards

- Sort of mortgage loans having fee earners

- How much ought i acquire?

Calculating payment money for mortgages

With regards to figuring commission-mainly based income, really loan providers come across exactly the same thing: the chance the profits is going to continue at the same top for the the long run. They would like to understand homeowner has the ability to repay’ their brand new financial fundamentally.

To determine percentage money for a mortgage, loan providers average their earnings over the past 2 years to arrive during the an estimated month-to-month income.

Lenders tend to generally average during the last 24 months from payment income, and employ the typical since your qualifying earnings when figuring obligations ratios.

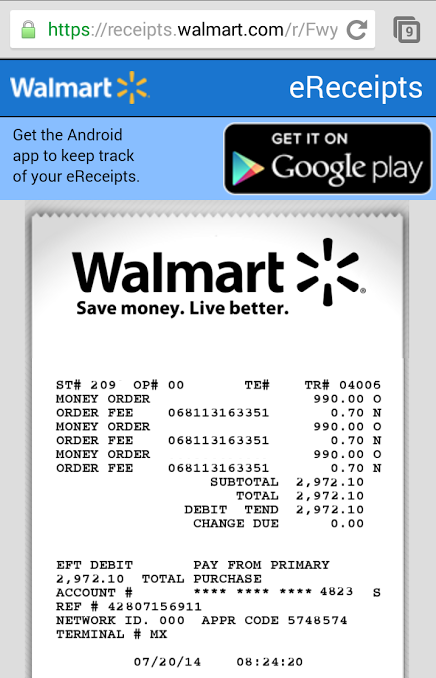

Such as for instance, state your own annual income are 100 % payment-situated. For the past 24 months, you generated $65,000 immediately after which $75,000.

To access a month-to-month money getting financial qualifying, the lending company carry out include their earlier a couple of years’ commission earnings and you may split from the 24.

- 12 months step 1: $65,000

- 12 months 2: $75,000

- Sum: $140,000

- $140,000 / 24 = $5,833

Inside example, the financial institution will suppose you may have an income out of $5,833 a month. It might upcoming determine the maximum loan amount and you may monthly payment centered on that number.

Financial standards to possess fee earners

Earliest, you desire a constant work historymission-depending earners typically must be on the job because a beneficial accredited wage earner for a couple of age just before their home loan application.

Sort of mortgage loans for commission earners

Federal national mortgage association and you may Freddie Mac – the latest firms one lay statutes getting compliant financing – fundamentally like a two-season minimal reputation for percentage income.

Fee income that has been obtained to have twelve to two years may be noticed, provided you will find pluses so you can fairly offset the smaller money records.

- Completed Request for Verification of Employment (Mode 1005 or Setting 1005(S)), or

The brand new FHA home loan program is far more easy regarding fee money; individuals may be able to become approved with only a single-seasons reputation of payment earnings.

Fee money can be used having FHA loans if the home loan debtor acquired the amount of money for at least 12 months from the exact same otherwise similar distinct work, additionally the money is reasonably attending keep.

So you’re able to qualify which have payment earnings, home loan borrowers must provide duplicates from finalized taxation statements towards the past 24 months in addition to their most recent spend stub.

The Agency from Experts Items is a little stricter than just FHA in this regard. To be thought active income getting a good Va mortgage, percentage earnings must be averaged along the previous a couple of years.

Very lenders will need your own past one or two years’ Federal tax statements (1040’s) with all of times so earnings is going to be securely determined. Some may enable it to be a written verification out of a position unlike a good spoken one from your own employer.

‘Significant variances’ – meaning a growth otherwise decrease of 20% otherwise greater when you look at the money on the prior 12 months – should americash loans Canaan be examined and you may recorded ahead of due to the money stable and you will dependable.

Simply how much financial should i be eligible for?

If you’ve attained about a couple of years of fee-oriented income and possess a powerful financial history, you might be on your way to help you financial approval.

Categorised in: how do payday loans works

This post was written by vladeta