Initiate the procedure before you can provides an effective COE

November 13, 2024 4:17 pm Leave your thoughtsBefore you go to get property, the home loan company will offer you a number of different home loan financing choice, away from old-fashioned fund to authorities-insured fund. Your loan choices could be novel for the finances, and will rely on different factors, including your credit score, debt-to-income ratio, fund having a deposit, and deals. Antique money often have more strict advice and higher downpayment criteria than just regulators-covered loans, and come up with bodies-insured loans a greatest option for of a lot borrowers. A government-insured financing is exactly what it sounds particularly – financing supported by government entities, whom guarantees payment into the bank if you standard on the mortgage repayment. Government-covered loans try backed by often brand new Government Houses Authority (FHA finance), this new You.S. Company off Agriculture (USDA money), or perhaps the You.S. Institution off Experts Things (Va funds).

Having eligible Western pros, energetic obligation armed forces, Reservists, people in brand new Federal Shield, additionally the thriving partners of pros, good Virtual assistant loan now offers a government-covered financing with advantageous terms and conditions.

Virtual assistant loan axioms

An excellent Virtual assistant financing is a hugely popular mortgage solution. But whom qualifies for these funds? You can be considered if a person or higher of the adopting the conditions apply to you:

While we already mentioned, Virtual assistant funds is supported by brand new Agency off Veterans Products (VA). Just in case you meet the requirements, this type of money require no deposit, zero private mortgage insurance policies, and offer freedom which have credit ratings.

Because the Virtual assistant fund is backed by the federal government, your lender’s risk are less, which allows these to be more versatile using their financing conditions, specifically credit score minimums and you will range. The minimum credit score necessary for of several lenders is actually 620, but conditions start around financial in order to lender. Atlantic Bay, for example, tend to potentially meet the requirements individuals who’ve a get with a minimum of 580, when they fulfill specific a lot more requirements.

Tricks for capital their Virtual assistant financing

Whether you are an initial-date military borrower otherwise an experienced homebuyer, when you find yourself looking for an excellent Virtual assistant loan, it assists to be educated and you will prepared on loan choices and techniques before buying.

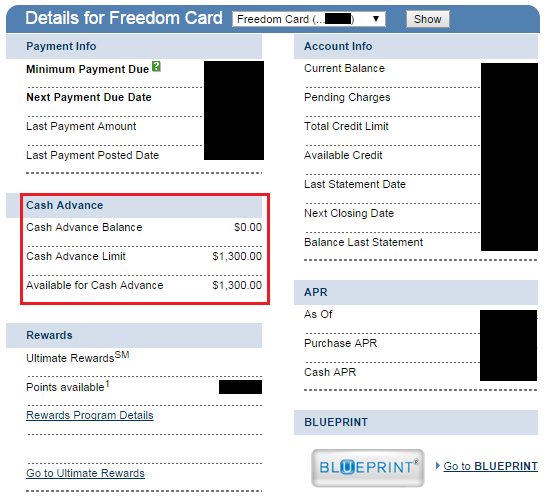

A beneficial COE is actually a Va Certification from Qualifications, which you are able to want to get good Virtual assistant financing. That it certification verifies your character and you can period of services. Although not, you do not have to own their COE at your fingertips in advance of you start the mortgage processes. Of many loan providers allow you to get the COE once you have currently become the mortgage processes, and many may also have the certificate to you personally. You could potentially make an application for a COE three different ways: throughout your Va acknowledged financial, online compliment of VA’s site, otherwise of the send having Mode twenty six-1880. Discover a long list of COE’s and ways to rating you to definitely on VA’s Web site.

Be aware of your credit report

Just like any real estate loan, your credit rating plays a very important roll in what your be eligible for. To help loan providers evaluate their credit worthiness, the newest Reasonable Isaac Company, known as FICO, converts all of the recommendations on your credit history to your a good matter – your credit rating. Your credit score ranges out of 3 hundred-850 and is made of 5 one thing: kind of credit rating, quantity of borrowing questions, period of credit rating, outstanding balance, and you may commission background.

Not sure what your score try? All the around three credit reporting agencies, Equifax, Experian, and TransUnion, enable you to check your credit history on the web for free after a great seasons. You can do things to aid alter your credit rating if it is not a bit in which you’d like it to be. Speak to your lending company, they could involve some tips to help to improve your own rating, also.

Select a good Va-knowledgeable mortgage banker and you may representative

Simply Va-recognized lenders helps you having an excellent Va loan. The mortgage banker will be able to give an explanation for Va financing unit and you will strategy to your, and you should feel comfortable planning them with questions or concerns. To acquire a home is a significant choice, as well as your mortgage banker will play a huge character from the process, therefore it is important that you trust them.

Specific mortgage lenders be a little more familiar and knowledgeable about Va finance than the others, therefore shop around prior to making a choice.

The same goes to suit your agent. A representative that have experience permitting Virtual assistant individuals could save you day and cash finally. Their real estate agent must also act as a way to obtain Va mortgage education for your requirements from the property techniques.

Your own Va qualifications never expires

Possibly you may be a talented family buyer and you may you have currently purchased a household utilizing your Virtual assistant eligibility. Good news! As you prepare to maneuver, you can aquire a unique Virtual assistant financing. You can reuse an effective Va mortgage as find more often since you wanted, as long as the earlier mortgage was paid back. Both educated and basic-day Virtual assistant financing individuals just who initiate your house to acquire procedure that have earliest Virtual assistant mortgage studies is actually means by themselves up for successful credit feel. So, be prepared and you may shop around with the Va money as well as their requirements. In that way, you might be ready and you may pretty sure discover your next domestic.

Categorised in: usa payday loan company

This post was written by vladeta