Investment property and you will second home loan cost in 2024

October 22, 2024 6:31 pm Leave your thoughtsTry second home mortgage pricing large?

It’s a common expectation that if you keeps a home loan to have most of your house (our home you live in), you could potentially expect you’ll obtain the same interest levels or loan offers in your next house. But that is usually not the case.

Whether you’re to buy the second house, vacation domestic, or investment property, you should allowed quite high financial rates and you can probably way more stringent qualifications requirements. Here is what you can expect – and what you can do to find a lower second home home loan speed.

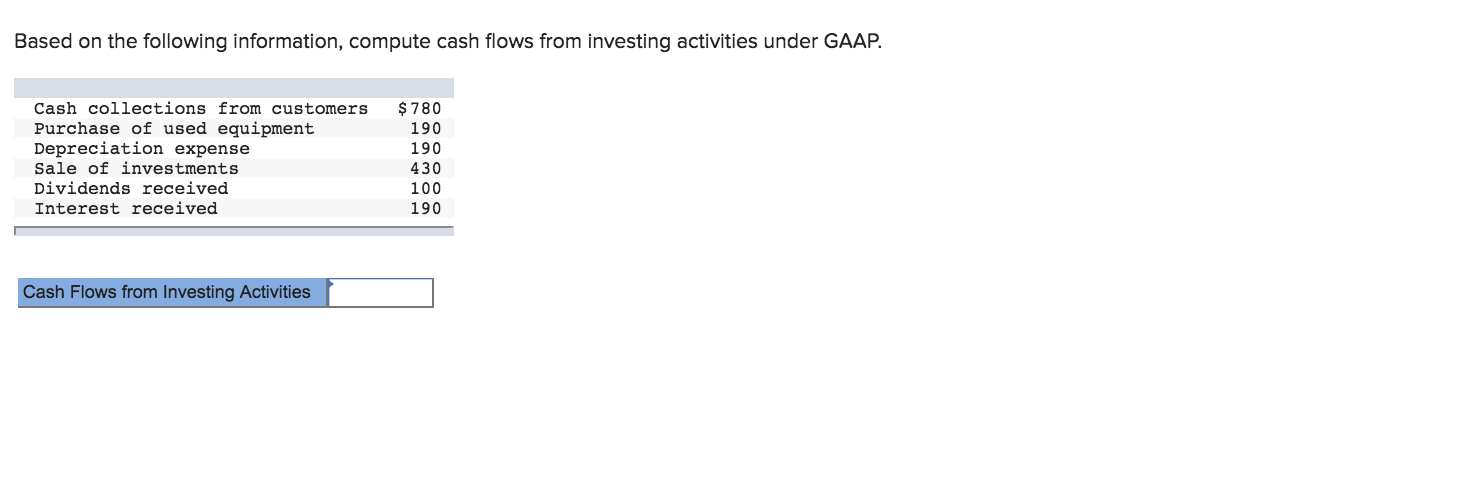

Second mortgage loan cost against. money spent mortgage cost

Fundamentally, investment property prices go for about 0.5% so you’re able to 0.75% greater than market cost. To possess an additional family or trips household, these are typically only a bit greater than the interest rate you’d be eligible for into an initial household.

- Next home loan home loan costs: Doing 0.50% higher than no. 1 house prices

- Money spent mortgage cost: Doing 0.50% to help you 0.75% higher than number 1 home cost

However, investment property and 2nd financial home loan cost however believe a comparable issues just like the number one home mortgage prices. Yours are different in line with the sector, your income, credit score, area, or any other affairs.

Whether your finances has changed because you bought very first family, your financial speed you’ll vary of the a wide margin than simply average. This might be genuine for family purchase and you can refinance costs for 2nd home and payday loans Epes you may leasing characteristics.

Next home mortgage cost and you can regulations

Some tips about what you should know in the 2nd home loan cost and requires when you need to buy a secondary home – one to you can easily live-in getting part of the year, although not full-day.

Occupancy: Part-time occupancy needed

Loan providers assume a holiday or next the home of be used by you, your loved ones, and you can household members for around the main 12 months. However, you are have a tendency to permitted to secure rental income towards house when you aren’t deploying it. Local rental earnings rules are very different because of the mortgage lender.

Next domestic rates: A little significantly more than market

A moment residence is perhaps not a primary residence, therefore loan providers select a great deal more chance and you will fees highest rates of interest. Although not, it is necessary to note that such cost are considerably more favorable than those associated with capital properties. The interest rate on the 2nd family are going to be lower than half of a % greater than exactly what you’d be eligible for into the an excellent top mortgage.

You will likely be required to establish at the very least 10% to possess a vacation domestic. Assuming your application isn’t as strong (state you may have a reduced credit rating otherwise reduced cash supplies), you’re necessary to build a down-payment off 20% or maybe more.

Credit history: 640 or higher

Purchasing an additional domestic or trips domestic requires increased borrowing from the bank score: generally 640 or over, with regards to the mortgage lender. Loan providers might see quicker personal debt plus value – meaning firmer debt-to-money percentages, otherwise DTIs. Reasonable cash reserves (even more finance from the bank immediately after closing) try a large assist, as well.

Money spent home loan cost and you may guidelines

This is what you have to know in the home loan rules when you’re to shop for a residential property: one you would not live-in anyway and you can propose to book year-round.

Occupancy: Not necessary

If you find yourself funding property as a residential property, and you may want to rent it out full-day, you are not myself necessary to inhabit the building to possess any timeframe.

Money spent loan pricing: 0.50% to help you 0.75% above field

Financial costs are quite some time higher to have resource functions. Often, their home loan interest might be 0.5% so you can 0.75% large to have a residential property than just it would be to have an effective first home. For the reason that lenders imagine rental homes is riskier out of a credit position.

Categorised in: i need payday loan now

This post was written by vladeta