Is it possible you score home financing to your advancing years?

November 27, 2024 9:05 pm Leave your thoughtsIs actually advancing years mortgage loans wise?

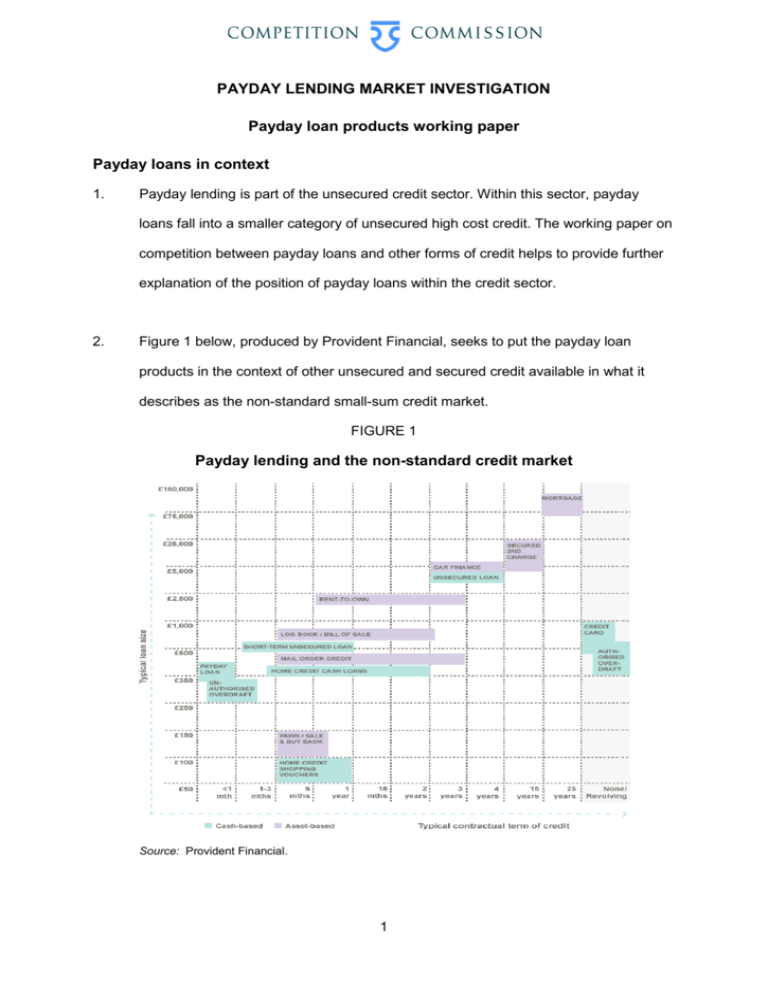

Even though a retirement home loan are a good idea is based on your private issues and you may requirements. Prior to taking away particularly that loan, it is essential to check out the associated threats carefully and ensure you understand most of the small print. It can be great for request a separate economic mentor to determine if these financing product is good for you. Generally, retirees have more rates-energetic selection, such as for example downsizing their home or opening security discharge schemes. Thus, weigh up all of the options before making a decision on a pension mortgage is best.

What exactly is a pension home mortgage?

A retirement mortgage loan is a kind of loan which is applied for because of the those people who are in the or addressing advancing years. In the place of other money, this type of loan generally has no need for monthly premiums, but instead contributes the attention onto the loan annually. Lenders commonly fees a top 1st rates of these money than just for those available to more youthful borrowers. The borrowed funds can either be used out just like the a lump sum payment percentage or in shorter instalments through the years and you will protected facing the assets. Once you perish otherwise transfer to much time-label proper care, the lending company will be paid back from your own house’s sales.

Yes, you can purchase home financing into old age. But not, there are certain requirements that need to be satisfied in check for you to meet the requirements, and the loan procedure are slightly distinct from regarding antique mortgage loans. Fundamentally, loan providers usually determine your credit rating, income and other economic factors to see whether or not you happen to be qualified to receive a retirement mortgage. It is in addition crucial to keep in mind loan providers may also wanted extra security, like a security discharge system or guarantor, prior to offering you that loan.

What is the difference between a lifestyle home loan and you can a retirement interest-merely mortgage?

Area of the difference in an existence home loan and you may a pension notice-just mortgage is the fact that second requires one to create regular money to pay off the loan. Which have a lives home loan, you acquire a lump sum payment and don’t need to make repayments up to immediately following your demise otherwise when you transfer to much time-title worry. In comparison, with a retirement appeal-merely mortgage you should make normal payments into the funding because the well since the make payment on focus monthly. This means you can obvious the loan harmony during your lives, whereas that have a life mortgage this isn’t you’ll.

What is actually a pension appeal-only mortgage?

A pension focus-merely mortgage was that loan which allows homeowners over the decades away from 55 in order to obtain a lump sum payment or small amounts to the a continuous basis. The fresh new debtor believes and make normal attention payments every month, but there is however zero criteria to settle some of the investment up until just after the passing or after they enter into long-term care. Interest-merely mortgage loans will benefit homeowners because they give specific monetary independence throughout the retirement while also letting them remain in their homes.

Who can get a pension desire-merely financial?

A retirement attract-merely financial is generally available to homeowners who will be across the age 55. To-be eligible, individuals constantly need to demonstrate that he has got adequate money so you’re able to cover the conventional desire repayments and you may express their intention to remain inside their property up until passing or long-name care. Particular lenders will additionally require proof of private offers and you may investments.

Mortgage loans for people more 60 should be cutting-edge. It is essential to look for independent, qualified advice of a completely certified elite group which knows the particular requires and you can affairs off more mature somebody.

Remortgaging is one of the most preferred choices for those lookin to help make the website the money kept off their household go next. Lloyds Bank also offers competitive cost, with conditions which might be specific into individual situation, taking into account people medical conditions or other activities which can affect your capability to repay.

Categorised in: who uses payday loans and why

This post was written by vladeta