Qualifications Standards to have Earliest-Day Homebuyer Apps for the California

January 10, 2025 10:47 pm Leave your thoughtsThe latest Homeownership Difficulty when you look at the California

While you are a renter for the Ca thinking out of homeownership, you have probably been struck which includes daunting amounts. Inside the 2024, the brand new average house speed when you look at the Ca is located at around $838,2 hundred, which is nearly twice as much national average home price of $439,455. California’s housing market keeps viewed a price raise around six.9% than the past seasons, given that national sector experienced an even more smaller increase out of cuatro.1%.

Of these regarding San francisco bay area, the challenge is even harder, that have average home values topping $1 million. This is no quick accomplishment, especially for earliest-date homeowners.

And make matters even more complicated, home loan cost provides grown sharply from their all-big date downs inside 2021. As of 2024, interest levels are higher than of several create guarantee, and you can forecasts show they may maybe not drop-off notably regarding close coming. Not surprisingly, there are a number of applications and methods which can help you earn your legs regarding doorway.

Here is the Very good news: California Also offers Assistance getting First-Big date Buyers

Ca has many of the very full earliest-time homebuyer applications in the country, made to let renters and you will tenants as if you overcome economic barriers last but not least very own property.

These programs usually promote less off money, straight down interest levels, and you will help with settlement costs. However, for taking advantageous asset of such apps, you need to see specific requirements. Let us falter all you have to be considered.

step 1. Debt-to-Income Proportion (DTI)

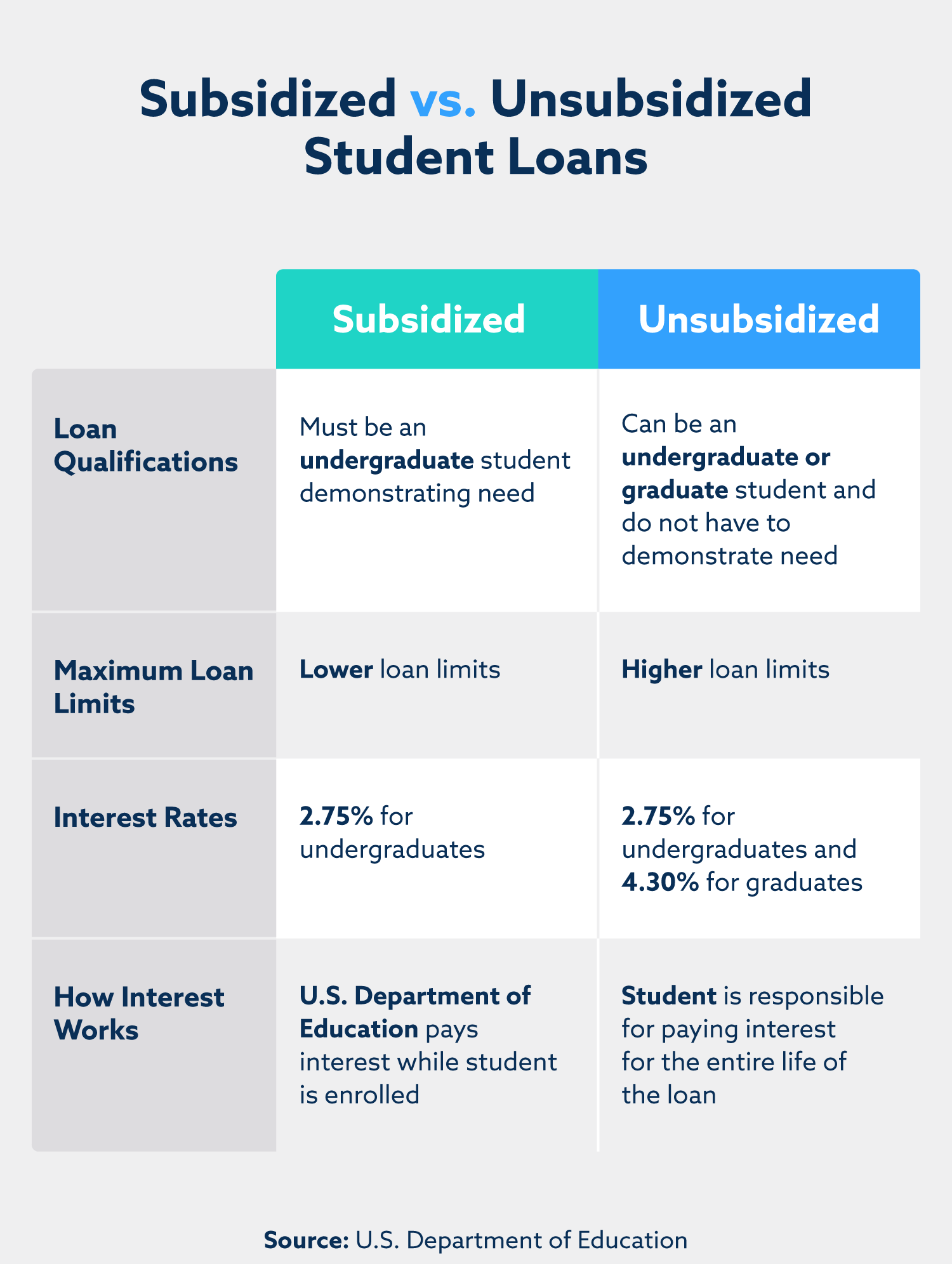

The DTI ratio is vital from inside the choosing your ability in order to meet the requirements for a home loan. Which ratio ‘s the percentage of your own monthly earnings spent on loans costs, plus credit cards, figuratively speaking, and you can auto costs. Really loan providers favor a great DTI ratio out-of 43% or less, although some apps might take on large percentages for individuals who satisfy almost every other standards.

2. Credit rating

Your credit score will likely influence not simply if your qualify for a loan, but in addition the regards to that loan, like the interest rate. A good credit score normally falls regarding the list of 670-739, while you are things more than 740 is recognized as advanced level online installment loans West Virginia.

In case your score is gloomier, don’t be concerned-there are credit upgrade steps you might use. Simple actions eg repaying outstanding balance, disputing mistakes on your credit history, and keeping a minimal borrowing usage proportion normally replace your get.

3. Money Limitations

Many California software has money limitations, meaning your household income should be less than a particular tolerance so you can be considered. This type of restrictions vary by the condition, so it is required to look into the income cap for your particular urban area. As an example, income constraints for apps in higher-cost nations including the San francisco are usually more than into the other areas of one’s condition.

4. First mortgage

To be eligible for this type of software, you must be a primary-day homebuyer, identified as someone who has not possessed a property in past times 36 months. Such software are designed to help those people who are and then make their basic major action towards homeownership, therefore whether or not you previously owned a home, you might still meet the requirements within the right requirements.

5. Number one Residence

Government entities advice applications from inside the Ca are concerned about permitting some one pick property it decide to inhabit full-date, perhaps not capital characteristics otherwise travel home. The house you might be to find have to be the majority of your house.

6. Veteran Condition

While a veteran, you are in chance! California has actually particular software, such as the CalVet Financial System, designed to simply help veterans pick homes with all the way down interest levels and you can positive terminology. These types of professionals are included in the new state’s commitment to helping those with served all of our country secure its bit of this new American Fantasy.

2024 Styles: Alot more Flexible Alternatives for Basic-Time Buyers

Within the 2024, the actual home sector features modified to handle the brand new constant cost things, particularly for very first-big date homebuyers. Versatile financing possibilities are very so much more offered, offering reduce fee criteria, closure costs assistance, and also gives in certain large-request portion.

Additionally, many lenders are in fact offering adjustable-price mortgages (ARMs) instead of the traditional 30-seasons repaired-rate financial. If you’re Fingers have a whole lot more exposure (rates of interest is change), they supply straight down 1st interest rates, that’s a casino game-changer to possess basic-go out people applying for for the costly avenues including the Bay Town.

The way the Cal Agents Helps you Navigate the process

At the Cal Agents , we understand how challenging this new homebuying processes might be-particularly in California. All of us works together first-go out people in order to browse the new network from regulators software and you will financing options available to you personally.

I supply a no cost A house 101 Classification to break down the entire process, of delivering pre-recognized to have a mortgage so you’re able to closing in your dream family. Regardless if you are simply doing your own homeownership travels otherwise are prepared to buy today, we offer individualized guidance predicated on your specific financial situation.

Likewise, we partner which have top loan providers just who focus on first-big date homebuyer apps, and now we can be connect your into greatest options for your means. For each and every lender has its own benefits and drawbacks, and you can our company is here in order to look at which ‘s the top complement your.

Sign up The A house 101 Category and start Your own Travels

While you are happy to use the next step with the homeownership, sign up us in regards to our totally free A property 101 Category. Our very own group covers everything you need to learn, away from information your credit rating to help you being qualified for basic-time homebuyer applications, therefore you’ll feel confident in to make told decisions.

Categorised in: payday loans bad credit direct lender no credit check

This post was written by vladeta