Realize these types of five strategies to evaluate your existing mortgage

October 9, 2024 10:07 pm Leave your thoughtsWhen you first got your financial, your credit score may not have been as effective as it is now. As a credit rating is one of the issues hence determines the rate offered when you take away that loan, your ount of money if you decide to refinance. Actually, if you now have a very solid credit history, a loan provider has a tendency to offer you a better rate of interest.

Often home owners opt for refinancing a mortgage to increase their monthly installments. This could are present following a cover raise, a marketing or other positive change in a household’s financial factors. With this specific more money to pay off a mortgage more easily can be beneficial. Refinancing a 30-seasons mortgage and you will going for a shorter title from fifteen years, as an example, carry out enable you to own your property outright earlier than anticipated and might help you save many thousands out-of cash in the attention payments.

For people who choose for cash-aside refinancing, the primary due on your property increases and therefore you will getting challenging if you choose to place your home into markets

When you grabbed your home loan, you do not had been capable manage a downpayment more than 20 percent of one’s dominating. If it are the actual situation, chances are you’ll have experienced to get Private Home loan Insurance rates (PMI). Yet not, if assets pricing possess since grown in your area, your home equity is now able to portray more than 20 percent away from the principal. If you think this is basically the case, you might method your own lender and ask for your own PMI so you’re able to feel terminated. Property appraisal will need to be carried out to verify your property have improved within the worthy of and this the fresh collateral now means more than 20% of one’s prominent. If for some reason the bank are unwilling to allow you to terminate the insurance, you could potentially choose for refinancing.

When your this new mortgage is short for less than 80 per cent of your latest assessment worthy of, so long as want PMI and can probably rescue within the very least $one hundred every month

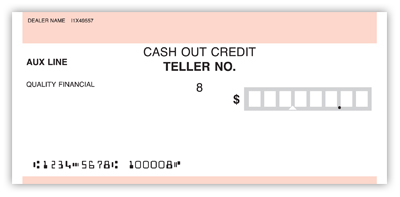

If you have were able to build up a sizeable level of collateral of your home and also features too much obligations, it’s also possible to wish to opt for bucks-out refinancing. This would entail taking on home financing http://www.cashadvancecompass.com/payday-loans-co/windsor having a heightened count than your currently owe. For example, if the a house appraisal reveals your house is value $three hundred,100 while your own a fantastic dominating try $2 hundred,000, there are gathered $a hundred,000 within the collateral. If you re-finance your loan having a primary out of $220,000, you will release $20,100 to repay some otherwise all your bills. Offered the rate billed on the mortgage is leaner than you to definitely recharged in your most other bills, you will be financially better off. In addition, you will additionally feel and also make one single payment per month.

Regardless of if bucks-away refinancing can often be used to consolidate obligations, you may be provided this package in order to take back currency to own other objectives, such building a connection or investing the kid’s education.

Refinancing is a pricey process and is always only recommended should you decide to stay in your house for during the the very least a couple of years. Though in most cases you’ll be paying shorter for every single few days towards your financial, it will take many months one which just manage to break-even. While you are considering refinancing, then use the RateWinner re-finance calculator to work out just how a lot of time it requires one to reach finally your break-actually point?

Categorised in: what is payday cash loan

This post was written by vladeta