Refinancing Their Home loan Playing with an enthusiastic FHA 203k Financing

June 12, 2024 12:16 am Leave your thoughtsThe fresh down payment need for a keen FHA 203k loan is similar to that out-of most other government-backed mortgage loans. Ergo, you’ll be able to spend 3.5% of full amount borrowed upfront for those who have a card rating away from 580 or higher. Likewise, needed at the very least a ten% down payment should your credit rating was below 580.

Thank goodness, taking a keen FHA mortgage is now smoother, due to down payment advice software from nonprofit organizations and cash merchandise of family members otherwise loved ones.

Debt-to-Money (DTI) Proportion

Lenders commonly examine your income, about your monthly expenses to choose if you qualify for the treatment home loan. To help you calculate their DTI ratio, financial financiers constantly split their gross month-to-month earnings of the total monthly obligations expenses.

Basically, a beneficial DTI proportion away from less than 43% function your be eligible for the borrowed funds. Such as, if you secure $5,100 per month, the limit costs limitation will likely be 43% of one’s overall earnings. This means that, your mortgage repayments, borrowing expense, or other expenses should not meet or exceed $dos,150 to keep up the most DTI welcome.

Household Occupancy

FHA 203k money are around for purchasing first belongings just. Ergo, if you are planning to invest in a multiple-fool around with property that has had a professional and you will residential product, you can not qualify for the borrowed funds.

Citizenship

Fundamentally, you need to be a beneficial United states citizen otherwise lawful permanent citizen so you’re able to qualify for the loan. Consequently, home loan financiers have a tendency to guarantee your own citizenship into the app way to ensure you legally inhabit a state inside The united states.

Mortgage Premium

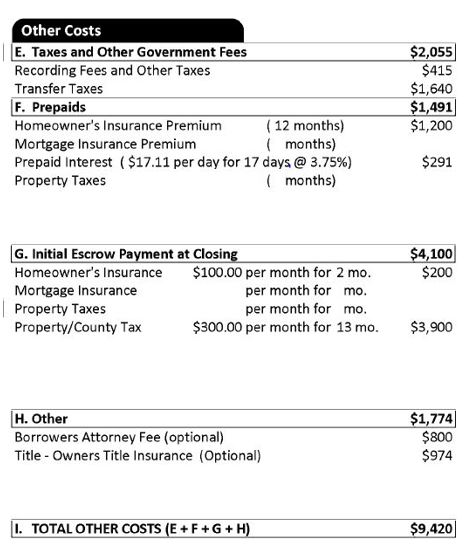

Exactly like most other government mortgage loans, an enthusiastic FHA 203k mortgage need several forms of insurance costs. First, it is possible to shell out an initial insurance coverage price of step 1.75% of the total mortgage in the a lump sum payment.

While doing so, you are able to spend yearly insurance fees anywhere between 0.45%-step 1.05% of your full amount borrowed. Mortgage brokers always falter the brand new yearly premium into several equivalent monthly premiums.

Very residents commonly ask yourself once they be eligible for a property renovation mortgage despite a domestic domestic. The truth is that for folks who currently very own a house, you could potentially however submit an application for a treatment mortgage to finance your own coming renovations.

Assuming you have a great FHA mortgage, you could re-finance the loan speedycashloan.net/loans/500-dollar-payday-loan/ around a smooth 203k program. Consequently, it is possible to be eligible for lower rates and you may, after that, straight down monthly payments.

Likewise, you are able to the loan in order to rehabilitate a fraction of your own a residential property, so you don’t have to get out of your own newest domestic. FHA-accepted loan providers provide customized repair fund to own licensed home owners. The new rehab system talks about do-it-yourself employment, including;

- Updating a patio pool.

Why does Household Recovery Create Value Toward Assets?

Providing an effective 203k loan to order and you may upgrade a property was a commendable financing. Not only will you getting a homeowner, but you will also add worth to help you a preexisting property owing to restoration.

Take advantage of Disregard the

Family renovation pledges a great return on the investment that fits your taste and you will needs. Imagine if you purchase good fixer-upper possessions in your well-known society. The house will have a reasonable price because wasn’t current for some time.

not, you can upgrade the house to suit the factors you desire. Performing directly having an approved consultant, you might determine the materials, construction, build, and you may tailored artistic stops. Fundamentally, when you finish the home improvements, you will end up came across understanding you came across your opinions.

Blend The Mortgage payments

Refinancing the financial having fun with a remodelling mortgage can help you mix the mortgage repayments, helping you save extra cash fundamentally.

Such as for example, if you purchase an old home with a permanently stained carpet, you might just take a limited 203k financing to resolve the latest carpeting or any other aesthetics. In the long run, you will have a revamped house and an alternate carpeting if you find yourself purchasing their mortgage to a single financial institution.

Categorised in: speedycashloan.net+500-dollar-payday-loan what are good payday loan company

This post was written by vladeta