Solution Getting Collateral From your own home

July 15, 2024 4:11 pm Leave your thoughtsWhen it comes to funding your residence, you to proportions cannot complement all of the. Even though conventional possibilities instance money, family security credit lines (HELOCS), refinancing, and reverse mortgage loans can work better for the majority homeowners, the newest latest go up out of loan choices eg household collateral traders and you will other emerging systems have actually made it clear that there’s an ever-increasing interest in other available choices. Find out more about solution ways to get security from the home, so you can make a far more advised choice.

Antique Possibilities: Advantages and disadvantages

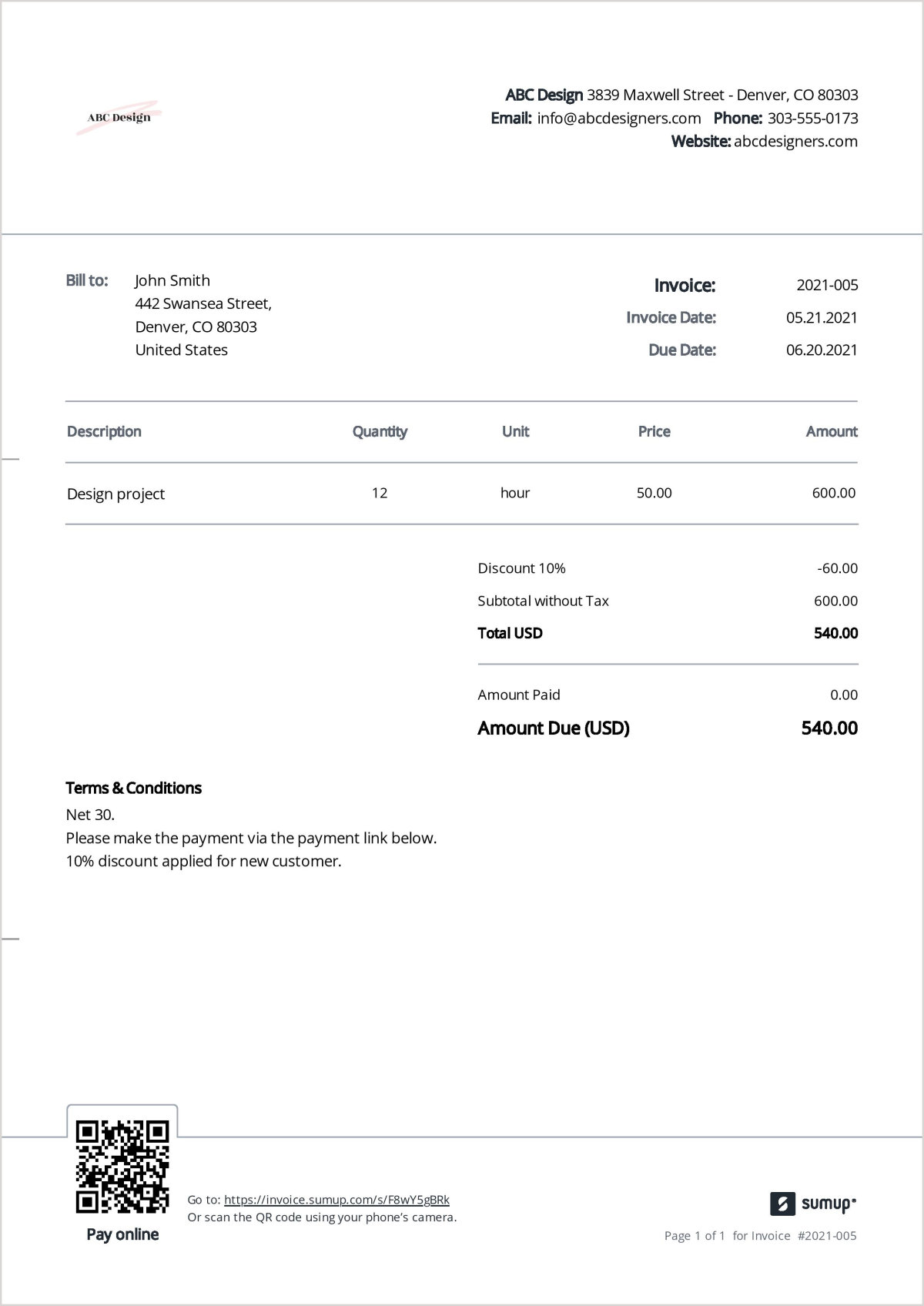

Funds, HELOCs, refinancing, and you may reverse mortgage loans could all be glamorous a method to utilize the newest security you have built up in your home. But not, discover usually as much downsides as there are positives – making it vital that you see the advantages and disadvantages each and every understand as to why specific property owners want investment selection. Understand the graph less than to help you rapidly contrast loan solutions, after that continue reading for much more all about each.

Home Guarantee Loans

A property equity mortgage the most well-known suggests you to definitely home owners availability their equity. You will find masters, plus a foreseeable payment per month because of the loan’s repaired appeal price, and proven fact that you’re getting new equity in a single swelling contribution payment. Thus, a home security financing generally makes sense if you’re looking so you’re able to safeguards the cost of a restoration project or higher that-regarding expenses. Including, your own focus repayments tends to be taxation-allowable if you’re by using the currency getting renovations.

Why search for a home collateral mortgage choice? A number of causes: First, you will have to repay the loan as well as your own normal mortgage payments. Assuming your borrowing is less-than-advanced level (below 680), you will possibly not even be recognized to own a property security loan. In the long run, the program process is going to be intrusive, complicated, and you can taxing.

Domestic Equity Credit lines (HELOC)

HELOCs, a familiar replacement for a home collateral financing, provide simple and fast entry to financing any time you you would like him or her. And while your normally need at least credit score of 680 so you can qualify for a beneficial HELOC, it does in reality make it easier to alter your get throughout the years. In addition, you are able to see tax advantages – write-offs doing $100,100. Due to the fact its a personal line of credit, there’s absolutely no attention due unless you remove money, and you will sign up for up to you want up to you struck your own restrict.

However with it autonomy appear the opportunity of extra personal debt. For example, if you are planning for action to pay off handmade cards that have highest rates of interest, you can wind up racking up more fees. Which actually takes place many times it is recognized to lenders as the reloading .

Several other significant drawback that will prompt homeowners to look for a great HELOC alternative is the instability and you will unpredictability which comes along with this alternative, because variability inside prices can lead to changing debts. Their bank can also frost your HELOC anytime – otherwise lower your credit limit – if there is a fall on your credit history or house worthy of.

Learn how well-known its getting homeowners as you to make use of having home loans and you may HELOCs, within 2021 Homeowner Report.

Cash-away Re-finance

One to alternative to a house collateral mortgage is actually an earnings-aside refinance. One of the greatest perks out of a profit-out refinance is that you can safer a diminished interest rate on your own home loan, and thus all the way down monthly premiums plus dollars to cover other expenses. Or, whenever you can create high payments, an excellent refinance would-be a good way to shorten the home loan.

However, refinancing has its own band of challenges. Given that you are basically repaying your existing financial with a new one to, you happen to be stretching their financial schedule and you are saddled with the exact same costs you cared for to begin with: app, closure, and you may origination costs, identity insurance coverage, and possibly an assessment.

Complete, you will shell out between a couple and you may half a dozen percent of one’s complete number your use, according to the particular financial. Nevertheless-called no-cost refinances will likely be inaccurate, once the you will probably features a higher rate to compensate. If your amount you happen to be credit are higher than 80% of home’s well worth, you’ll likely need to pay to possess personal financial insurance coverage (PMI) .

Clearing new difficulties of software and you can qualification can result in deceased concludes for almost all home owners with imperfections on the credit history otherwise whose scores just aren’t sufficient; most loan providers wanted a credit rating with a minimum of 620. These are simply a few of the explanations people will see on their own seeking a substitute for a money-aside re-finance.

Reverse Mortgage

Without monthly premiums, an opposing financial should be good for more mature homeowners searching for more cash throughout old-age; a recently available estimate on National Contrary Mortgage lenders Connection receive one to older persons had $eight.54 trillion tied inside the home security. But not, you’re still accountable for the payment from insurance rates and you may taxes, and want to stay in our home into the lifetime of the borrowed funds. Opposite mortgage loans likewise have an age requirement of 62+, which regulations it since the a viable selection for of numerous.

There is lots to adopt when examining traditional and you can option an approach to supply your house equity. The next book can help you browse each choice even more.

Seeking a choice? Enter the Family Guarantee Capital

A more recent alternative to home security loans was family guarantee investment. The benefits of a home security investment, particularly Hometap has the benefit of , or a contributed fancy arrangement, are many. Such buyers make you near-fast access to your equity you have built in your property in replace getting a portion of the upcoming really worth. At the conclusion of the new investment’s active months (and this depends on the firm), you settle this new funding by purchasing it out that have savings, refinancing, otherwise offering your property.

Which have Hometap, as well as an easy and seamless application process and unique qualification requirements which is have a tendency to alot more comprehensive than compared to loan providers, you have some point out of get in touch with on the capital feel. Possibly the vital variation would be the fact instead of these more traditional streams, there aren’t any monthly payments otherwise notice to be concerned about toward finest of mortgage payments, in order to achieve your economic wants faster. If you’re seeking to choice how to get security from your family, working with property collateral trader could availableloan.net/personal-loans-vt/jacksonville be worth exploring.

Try a good Hometap Investment just the right home guarantee loan substitute for you and your possessions? Need our very own four-minute test to determine.

We perform our very own best to guarantee that everything in the this information is because the real that one may since the newest day its authored, but one thing transform quickly possibly. Hometap will not endorse otherwise display one linked websites. Personal factors disagree, thus consult with your individual financing, tax otherwise law firm to see which makes sense for your requirements.

Categorised in: availableloan.net+personal-loans-vt+jacksonville payday loans very bad credit

This post was written by vladeta