Student loan Bucks-Out Refinance: What you should Learn

September 17, 2024 4:00 pm Leave your thoughtsAlong with $step 1.75 trillion into the education loan debt in the us, individuals is actually searching for forgiveness potential. Although some forgiveness is out there to educators and you may social servants during the particular ranks, such options are not available to any or all, leaving of numerous interested in an answer.

College loans prohibit consumers from to make online payday loan services tall lives choices, including setting up a deposit getting a home. Thank goodness, consumers in search of homeownership can enjoy a student loan cash-aside re-finance system. This choice even offers people the flexibility to pay off highest-focus student loans when you’re possibly refinancing to a diminished home loan attract speed.

Even though this system isn’t really precisely an excellent forgiveness system, it does ensure it is borrowers to help you tie student loans and you may mortgage payments with the one percentage within a lower interest rate.

Within post, we fall apart which student loan bucks-away refinance program to determine whether or not they is right to suit your state.

What’s a funds-Aside Refinance Transaction?

Since the 1970, average student loan loans has grown by the more 3 hundred percent. Having typically more than $30,000 inside education loan obligations each graduate, it’s no wonder borrowers are searching for student loan forgiveness programs. Also the apps i in the list above, brand new solutions is actually emerging, such condition financial apps offering certain otherwise total personal debt save.

Probably the most well-known education loan recovery possibilities is through education loan dollars-away refinance programs. Such software are similar to a timeless dollars-aside re-finance exchange, which enables mortgage owners to change a classic mortgage having a good new one who has got more substantial count than just due towards the earlier mortgage. This will help to borrowers explore their property mortgage to gain access to dollars.

For those who should pay off student education loans, a student-based loan dollars-away refinance is largely like a funds-away refinance system, nevertheless the more cash regarding the mortgage pays pupil loan loans.

Highlights out of Education loan Bucks-Aside Re-finance Software

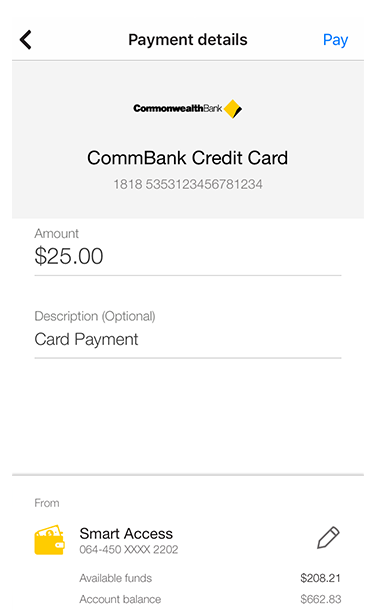

Student loan cash-out re-finance applications create student loan financial obligation cost compliment of a property mortgage re-finance. To get eligible, one or more education loan must be paid off by sending money into education loan servicer at the closing.

Even more Uses of one’s Cash-Away Refinance

Even though the pri is to pay off education loan loans, the borrowed funds could also be used various other implies. If your debtor does not want to pay off new entirety regarding the student education loans, they could desire repay almost every other financial-associated debt. Such as, consumers should pay off:

- An existing first mortgage mortgage.

- Financing to pay for will set you back into a separate build domestic.

- Closing costs, affairs, and you will prepaid issues, not including a property fees that are over two months unpaid.

- Using liens familiar with find the property otherwise included in the the fresh new home loan.

On the other hand, the brand new debtor ount is not over 2 per cent of your brand new re-finance matter, or $2,000. The new borrower may also be refunded from the lender when they accumulated overpayment out of charges thanks to federal or state laws otherwise statutes.

More information

To receive some great benefits of an educatonal loan refinance program, the mortgage should be underwritten because of the Desktop Underwriter (DU), an underwriting system one to Federal national mortgage association will spends and you will, sometimes, the fresh Federal Property Authority. No matter if DU doesn’t identify such transactions, it will post a contact whether or not it appears that student loans was noted reduced from the closure. That it message will inform loan providers of one’s loan criteria, but the lender have to confirm that the loan fits most of the conditions away from DU.

Keep in touch with that loan Administrator In the Student loan Cash-Aside Mortgage Conditions

Within distance, do not believe real estate must be hard. Therefore we definitely don’t imagine you have to place your hopes for homeownership toward hold on account of figuratively speaking.

While interested in learning a little more about education loan dollars-aside refinance choice-and a student-based loan refinance system-contact one of our Loan Officers. They will be happy to make you considerably more details.

Categorised in: how to get a payday loan with bad credit?

This post was written by vladeta