What exactly do mortgage lenders find on your own credit file?

November 22, 2024 3:30 am Leave your thoughtsWhile you are thinking-working, you might have to bring as much as about three year’s property value levels with your financial comments to prove your revenue try secure.

Being regularly overdrawn or a record of pay day loan will be red flags to lenders. If you’re planning to apply for a mortgage in the next three months, then it’s best to avoid any bad habits in the months leading up to your application.

Your credit score is a vital component that loan providers commonly consider when looking at their mortgage software. They’ll be checking having a confident credit history observe how well you handle your money.

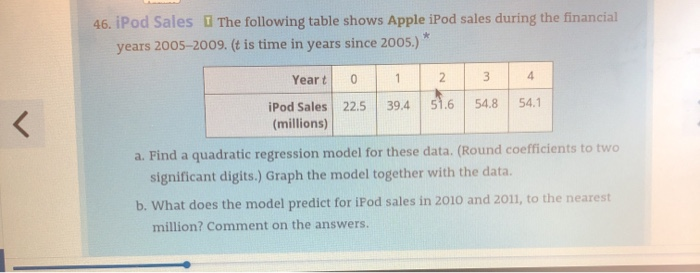

Just what credit score manage home loan organizations find?

Truth be told, you don’t have a one-size-fits-most of the credit history. You might be ranked in different ways from the some other credit bureaus with her scales. Loan providers will look at your credit rating regarding the three big Uk credit agencies: Equifax, Experian, and TransUnion. Each department features a somewhat some other way of positions you, so it’s best if you feel advised of your own rating with them.

Linked money for those who have people combined levels, the financing history of the individual you’re regarding will be considered

The addresses if you’ve got loads of early in the day tackles within the an initial space of time, this could functions against you

Such wide variety are merely a guide, it’s possible to score a mortgage whatever your credit rating, however, usually the high the new get, the easier and simpler it can be to locate approved.

Even though you’ve money loan in Reece City got poor credit, doesn’t mean you can not score a home loan. I encourage using Checkmyfile to find their score. Checkmyfile reveals your own borrowing from the bank pointers off around three significant borrowing reference companies, and that’s the quintessential comprehensive treatment for look at the history into the great britain.

What credit score do i need to score a home loan?

It is an excellent concern, although not that with an easy answer. Because the an effective ‘universally accepted credit score’ doesn’t in fact exist, i don’t have the very least credit score you should get a good financial. It’s possible to get a mortgage any your credit score, however the down that get is actually, the greater difficult it gets.

Get tips on how to improve your credit score before a mortgage application in our Guide Ideas on how to improve your credit history before applying having a home loan.

Let’s say We have poor credit?

Very mortgage brokers will want one has actually an acceptable borrowing from the bank rating prior to they shall be willing to offer home financing. But there are professional mortgage brokers who will thought you that have an extremely lower otherwise zero credit score if you have not was able to build a credit rating yet.

If you need a mortgage but are worried about your credit score, the door of your dream home isn’t necessarily closed to you. You’ll probably just need a specialist mortgage broker to get you the right mortgage. Get matched to your perfect mortgage broker by making an enquiry.

Just what possessions perform mortgage brokers take a look at?

Property is issues very own with a value. This might be dollars savings, possessions and other worthwhile items like an auto, graphic, or jewellery. Mortgage companies will think people possessions maybe you have when reviewing the application. When you have an urgent situation, make use of the amount of money because of these assets to blow your mortgage. This is going to make you look less risky so you can possible lenders.

What is actually a good put having a mortgage?

Deposit conditions differ anywhere between lenders. A beneficial good’ put is dependent upon the expense of the home, nevertheless the average deposit to have a mortgage in the uk was 15% of the total cost. If you have a poor credit score, you may want to place off a more impressive deposit in advance, once the you can easily essentially be seen since a high chance in order to loan providers.

Categorised in: which bank do cash advance

This post was written by vladeta