What’s an enthusiastic assumable financing, and you may preciselywhat are some standard considerations?

January 6, 2025 5:16 am Leave your thoughtsThere are many different loan possibilities so you’re able to homeowners. Whether or not a first-time buyer or a veteran in the industry, getting the right loan and you will understanding the benefits and drawbacks was crucial.

Rather than heading out and applying to additional lenders to get the money had a need to buy the household, the buyer can take across the seller’s mortgage already in place, plus their rate of interest. It’s an opportunity for a purchaser to invest in property which have a reduced interest and you can monthly obligations.

Manufacturers can benefit out of assumptions. A vendor will sell at the market value…maybe not the worth of the mortgage… nevertheless buyer have so much more to get energy within loan’s all the way down interest.

Assumptions is actually you are able to on condition that the fresh new seller’s loan is Virtual assistant or FHA, maybe not a conventional loan, and many downsides can be found. A vendor have the Virtual assistant qualifications tied because of the assumption, for example its eligibility and you will capacity to acquire an alternative Virtual assistant financing would-be challenging. This is especially true if a low-veteran assumes on the mortgage.

The customer must manage to pay money for the newest guarantee from the assets when of course that loan. What if the seller got that loan for $450,000 in the step 3%, and additionally they had that loan five years in the past. For the past five years, these are typically investing to the loan as house’s really worth has increased. The seller would not sell our house to the amount borrowed; they’re going to sell on good ount. When they ount has been repaid so you can $400,000, then your visitors must assembled this new $100,000 guarantee huge difference. That it have a tendency to limits the fresh new client’s possibilities because they don’t feel the dollars very important to the difference. On top of the collateral distinction, buyers often still have lender and you can recording charge whenever incase an excellent loan. The customer may also you prefer currency to pay for men and women costs.

The customer you can expect to and obtain the second loan to cover the change, however, financing will have to be tested by the lending company allowing the belief. They might or may well not choose approve that 2nd loan. Brand new security needs to be included in the consumer irrespective.

Whether your seller’s interest rate are step 3%, one to rates comes after financing

Assumptions need a lengthier mortgage approval date. On the late 1990’s, presumptions were made most of the time regarding housing marketplace. Today, loan providers no longer has departments to manage these types of finance. The procedure might take as much as 70-120 months. The average closing returning to Northern Virginia is 30-forty-five months, therefore expect the mortgage presumption way to get somewhat more than a regular deal.

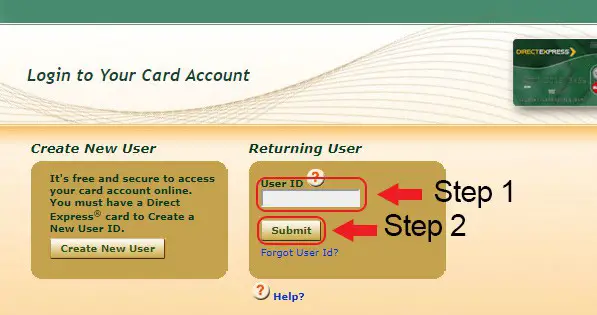

Perseverance is key. Inside an assumption, the customer talks to the new seller’s lender. Buyers are not looking for its financing, so the initial step ‘s the provider needs to enable all of the functions involved to speak with each other. Once which is covered, the customer may start sharing their recommendations towards the seller’s bank, as well as the customer need certainly to still qualify for the loan out of good credit standpoint, and you will an appraisal could be over.

Occasionally, customers assume a protected loan throughout the supplier, also known as a presumption

Bottom traces take the brand new move. Providers are and come up with money for the mortgage, in addition to bank continues to be battery charging appeal each day, so that the assumed loan amount is actually a moving address. Knowledgeable world professionals will get the fresh new numbers on ballpark, however, numbers will continue to go on to this new settlement big date because the sellers remain monthly premiums and you will every day interest accrues.

Things are prorated. Owner pays for what you to the newest settlement go out, and buyer gets control once. Fees and you may HOA charge will be prorated, and you will desire is actually billed each and every day and needs is paid from the the correct class. There is new escrow membership to look at. The buyer have a tendency to inherit the brand new escrow membership because settlement is concluded; owner will need to be reimbursed into escrow money regarding the customer.

Prefer a skilled term company. Since the assumptions is expanding once again, prefer a concept company who’s got sense paying down with the models regarding fund. At the Highland Label + Escrow, i pride ourselves with the bringing simple agreements regardless of the loan. Contact us now .

Categorised in: advance american payday loan

This post was written by vladeta