When you yourself have 20% or even more spared, then your home loan would not be covered by new strategy

December 31, 2024 10:52 pm Leave your thoughtsCaleb Gray, a customers agent on Top Property Group, in depth two tips for earliest home buyers to stay to come on the brand new FHLDS.

Buying during the a area – Of numerous household and residential property packages are in greenfield house and this lack scarcity and standard motorists to own assets increases. These types of characteristics was extremely vulnerable to declining in the worthy of as an alternative than admiring. Smart earliest home buyers get established land within the created suburbs one consist of upcoming growth people.

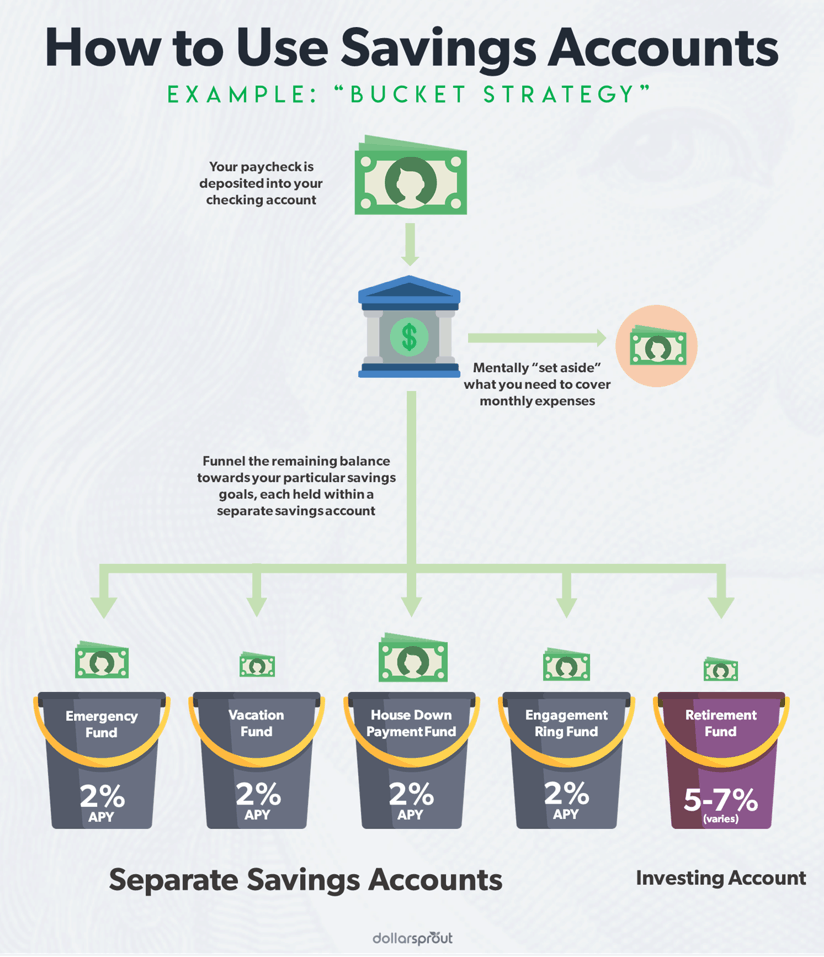

With a buffer – Whether or not your house does decline in well worth, these loses are not realised for those who have a very good shield out-of deals and are capable maintain home loan repayments. This may also be employed having a wet day for those who were made redundant. Its normally better if homebuyers need to have step three-1 year property value expenditures into the offers.

However, there clearly was you to definitely main issue with the fresh new FHLDS: the federal government wants you to use Your entire savings with the household deposit.

Saving step 3-a dozen months’ property value expenses you may mean youre ineligible to own new Program. The newest Government’s webpages says: The five% should be composed of legitimate offers local payday loans Bon Air AL.

On the financial support places, the brand new builds who does fall under the property speed thresholds (regarding that after) would generally speaking enter greenfield estates, far out of area middle, instead of situated suburbs nearer to new CBD. Unless you are willing to find an unusual jewel otherwise dilapidated assets nearby the town so you can knock-down, you’re certain likely to have to lookup subsequent away.

Such, CommBank already offers their ‘Extra Domestic Loan’ having a changeable 2

While it’s always handy and sensible for an urgent situation finance built up, this new FHLDS essentially wants one to pour that it to your family put (in case it is according to the 20% deposit cover) rather than save yourself it for a rainy go out. On top of that, certain state and federal home building features your availability could also indicate you will be ineligible into the FHLDS. Also, understand that shares or any other assets are usually felt genuine deals – and if you are standing on a deposit of over 20%, do not think you can link lots of it up during the brings in order to be considered. Men and women looking to games the system because of the protecting the borrowed funds having an excellent 5% put just before all of a sudden discovering 15% so you’re able to pour to the loan’s offset account is from fortune.

Because the NHFIC (the newest scheme’s manager) claims within the help guide to the fresh System: …it is vital that that you do not try to disadvantage almost every other Australians of the seeking alter your situations simply to utilize of your own Scheme. This includes for which you features a beneficial 20% or greater deposit and you will legitimately import your hard earned money or any other assets managed only to supply the brand new Program…

Highest mortgage will cost you and you can lender limitations

Whether or not consumers normally secure a home loan with a 5% put without having to pay LMI within the FHLDS, they’re however repaying interest toward 95% of your house’s value, in the place of 80%.

A similar home loan for consumers with a keen LVR out of a whole lot more than simply 80% has an interest price of 3.13% p.a good. (step 3.14% p.aparison speed*).

Yet not, Lendi manager David Smith says the fresh new scheme’s lenders hope they don’t charge FHLDS individuals higher rates than just equivalent consumers staying away from the fresh new design.

If you are participating lenders will get implement their unique even more standards having finance considering under the Scheme, instance restrictions for the specific functions or suburbs, all of the participating loan providers possess committed to not charge eligible earliest house buyers high interest rates than just similar individuals outside the Scheme, the guy said.

Categorised in: no credit check payday loan lenders only

This post was written by vladeta