Zero Credit score assessment Home loan Choices for 2024

October 24, 2024 7:46 pm Leave your thoughtsVery mortgage system assistance wanted lenders to use the credit ratings and you can borrowing passion just like the an initial reason behind giving the home loan. There aren’t any credit check mortgages readily available which can help in the event the youre concerned about your credit ratings when applying for a mortgage.

While concerned about your credit rating something on your own credit history, then it’s you can easily you’ve not been talking to new best bank. You can purchase a mortgage which have sub-standard credit ratings. You should use rating a mortgage that have derogatory points on your credit history. In the event the people is the factors, then it’s it is possible to you don’t need a no borrowing from the bank check home loan, but simply have to consult best bank.

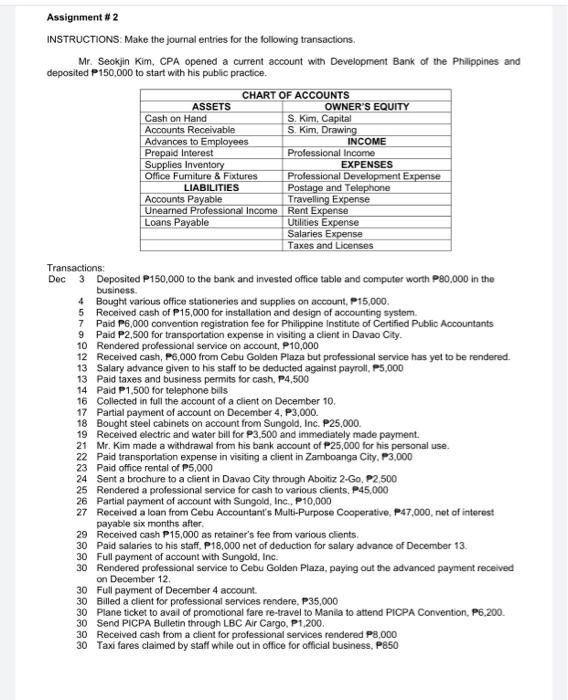

What’s a zero Credit assessment Home loan?

A no credit score assessment financial is one where financial does maybe not play with fico scores because a basis to help you agree the loan. Loan providers and you can lenders use your financial profile and down fee just like the a variety of security to agree your financial.

You will probably find the lending company examining to make sure you carry out n’t have a case of bankruptcy otherwise property foreclosure ensuring that consumers dont angle additional risk. The application also can experience a handbook underwriting process.

Zero Credit score assessment Mortgage Solutions

If you are worried about the lending company checking the credit, the mortgage choices below are available. These types of cannot work with all of the activities however for the majority of people talking about viable options.

FHA Streamline Re-finance

In case the existing financing is actually an enthusiastic FHA loan, you could refinance with no financial using your borrowing as the an excellent base to approve your loan. FHA direction none of them the financial institution to make use of credit because a grounds to own granting the mortgage to possess an improve re-finance. As a result, your credit scores can be quite lower and you may however get an affirmation.

The lender tend to pull their credit only to make sure if your make late home loan repayments. Regarding a card direction, that is the simply thing which will result in blocking your home loan approval.

It is important to remember loans Twin listed here is your current home loan need to getting a keen FHA mortgage to qualify for an FHA improve re-finance. In addition, you need certainly to be consuming our home since your primary quarters.

Virtual assistant IRRRL

Brand new Virtual assistant IRRRL ‘s the Va rate of interest reduction refinance mortgage that’s much like the FHA streamline re-finance program. Simple fact is that VA’s version of you to definitely system and now have really does not need the lender to make use of credit scores as the a foundation to suit your home loan recognition.

The intention of the new re-finance is to lower the attention speed, reduce steadily the repayments, or help the mortgage conditions in some way that work for your. Your existing mortgage must be a great Virtual assistant mortgage so you can meet the requirements.

The lender look at the credit file simply to make sure that you have started and work out timely mortgage payments.

Personal Money

Whenever investment with an exclusive money-lender , you might maybe not come across a credit score assessment. Such financial tends to be a neighbors, cousin otherwise anyone your fulfill who’s money so you’re able to give for the replace to have a higher rate of interest. Unlike additional selection referenced more than, private currency can be used to purchase a property, not simply refinance.

Individual money financing don’t have any particular assistance you might negotiate all of your own words including the interest, deposit, and label of your loan. The most challenging part are finding that private money lender.

Difficult Money

Very tough money loan providers do not pull borrowing from the bank for sales and refinances. Difficult currency finance always include the highest interest and you will the most items. They are utilized getting brief situations like a bridge financing or boost and flip disease.

Categorised in: is cash advance a loan

This post was written by vladeta