Credit history considerably affects the mortgage count and you may interest rate

January 19, 2025 10:04 pm Leave your thoughtsTo have around the world college students since a group, many email address details are one to purchase property is far more reliable than leasing. You will find several things about that it:

First of all, there are many unsound issues from inside the leasing a flat. Instance, the challenge of getting collectively between the foreign pupil additionally the property manager. Chances are result in a great amount of too many issues. Due to the difference between way of living activities, in addition to unsatisfying every day life is gonna change the investigation due to the fact really.

Furthermore, using a house to help with training is one of the most crucial ways to have foreigners to bundle the property. To shop for a property is not only a method to real time by the on your own, and in addition a way to lease it to other college students. Ascending rents may also increase the worth of our home. Normally, when for each renter cues a rental, there is an annual rise in new lease. With respect to the town, the rise can often be within 3-5%. Homes which can be next to colleges are generally not problematic so you can rent.

step 1. Preparing the brand new Down payment

When you’re inquire can also be people from other countries get property during the u . s . that have highest home prices and you may a hot field. We recommend that you may have at the least good 20% down payment at your fingertips with your Choose condition. The aim is to have the believe to pick up a house. Many global college students who have only been performing you need the parents’ make it possible to funds the new down-payment.

Also direct financial remittance. You’ll be able to choose certain high all over the world money transfer organizations, for example Currency Gram and Wester Commitment. This type of remittance programs be more authoritative and you will credible. And the charge are a bit less than financial institutions, therefore the coming go out might possibly be shorter.

dos. Realize about Your credit score

If you would like spend smaller to suit your loan, and purchase a expensive home with faster downpayment, you will want to keep a good number.

Along your credit history, what number of credit lines, the real history out-of loan payments, the type of borrowing, and so on. The influence your credit score. Credit ratings try closely linked to a person’s existence or take time for you to build up. It is important ‘s the FICO rating .

Money try valued inside the steps, installment loans in Idaho usually 20 products an amount. To have a good Jumbo financing, it is 760-780 to have tier step one. Another level are most of the 20 products. Old-fashioned fund are 740 for level 1. So if you’re a lot more than 760, the rate would be a tiny down, but not by the far monthly.

Within this process, you’ll want to look for a realtor. An agent was a member of a bona-fide house organization. He’s high conditions in addition to a lot more tips to browse for authoritative data and you may statistics for you to create yes you find an informed assets to you personally. Also they are accountable for enabling you to: Guide viewings; Praise viewings; Negotiate rates; Answr fully your inquiries and concerns.

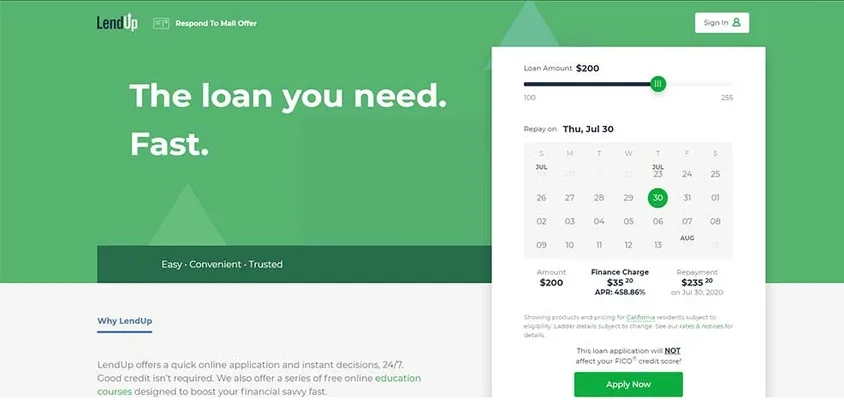

cuatro. See a loan company

Financing in the united states can be obtained from a choice regarding banking companies. Loan guidelines are normally taken for lender to help you lender, and you may off one state to another. A variety of updates, some other financing reserves, suitable loan streams won’t be the same. For this reason, what type of financing channel are chose, otherwise might be assessed toward specific problem. To take out financing you should give your own passport, work guidance, income recommendations, and you will existing discounts.

But not all the loan providers have the ability to render money so you can youngsters to the Choose so you’re able to control exposure. There are certain lenders in the business that can provide loans to help you youngsters into Choose. When it comes to interest rates, Decide finance are basically to the level which have H1B. Even though they was seemingly more than regular loans. As for just how much you could potentially borrow, loan providers essentially merely enable you to carry as much as forty five% of your pre-tax salary into the monthly payments.

Categorised in: a cash advance

This post was written by vladeta