Income tax for the foreign money: British household and you can income tax

March 31, 2025 2:57 amArticles

It allows to own greatest economic management and much more precise choices. At the time of creating there is certainly a bonus allocation away from £five hundred so you manage pay tax to your one number more than you to. Like with Investment Growth Income tax, it was a lot higher in the much less distant earlier. Observe, really investment platforms help investors make purchases out of exchanges everywhere these months.

International college students whom over its knowledge in the uk and you will need to to stay is also changeover so you can a visa group leading in order to ILR. For example, after finishing your own training on the a student charge, you can even change to a-work visa otherwise family members visa, eventually resulting in United kingdom long lasting abode just after students visa. There isn’t any specific upper British long lasting household ages restrict, but minors making an application for ILR need to usually take action since the dependents of a grown-up who already keeps or perhaps is obtaining ILR.

It’s an easy little bit of application one to alter their Internet protocol address, which means you have access to to the-request articles otherwise alive Television as though you used to be at the household. If one thing provides you against purchasing the home permit on line, you could potentially nevertheless fill in our contact page and receive suggestions from our experts. In the event the claiming overpaid All of us income tax, it would be wanted to both prepare the newest 1040NR income tax get back and getting linked to the return because the proof of withholding. Zero, you can’t personally pick long lasting residence, but you can invest in the uk thanks to specific visas including the brand new Investor Charge, that could lead to ILR. The application for long lasting residence may seem daunting, but by knowing the processes, you could potentially approach it confidently.

What exactly is an us Lookup in the uk?

Of these which have indefinite log off to remain (ILR), BRPs are typically granted to own 10 years. The fresh Citizen try a western scientific crisis television show you to transmit to the Fox from January 21, 2018, in order to January 17, 2023. The new collection debuted on the Fox as the an excellent middle-seasons replacement in the 2017–18 tv 12 months. To own basic checks, sign up for an on-line characteristics membership as opposed to using the Inform Solution. When you yourself have questions otherwise concerns about your absences from the uk on your own charge, applying for ILR, and other thing you have on the Uk visas and you may immigration, IAS are here to aid.

Come back to great britain should you have indefinite log off to keep

Start by knowing the about three main parts of the fresh SRT- the fresh automatic to another country examination, the fresh automatic United kingdom tests, and also the adequate links try. For many who’re also offered back into great britain over time overseas, https://vogueplay.com/tz/play-ojo-casino-review/ understanding the implications from repatriation on your income tax reputation is essential. Navigating the difficulties from split up year medication requires a thorough expertise of one’s standards per particular instance, so it’s tricky. Looking to professional cross-edging monetary guidance is highly recommended to ensure exact app and you will adherence to help you British tax laws and regulations. If, but not, the house status remains uncertain, the fresh adequate ties sample may be used to explain the house condition after that centered on additional involvement with great britain.

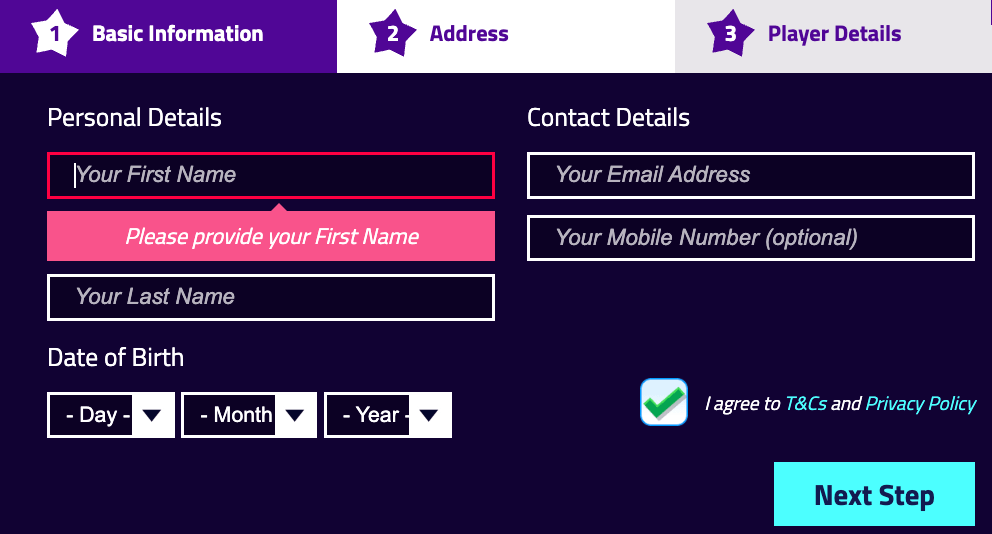

We recommend talking to a professional attorneys during the Immigration Guidance Service prior to making any choices based on the blogs considering. You must finish the app, fill out the mandatory documents and pay the payment. Sign up for an annual bundle now and have an extra 90 days totally free.

Files your’ll you would like

- Such as, Ireland features a two fold-tax treaty to your You enabling most Irish domiciled ETFs to get dividends away from All of us organizations just after a good 15% deduction to own withholding taxation.

- You might discover membership in britain, Us, Europe, Hong-kong, Japan, and Australian continent.

- Full information on the newest Scheme and you can financial communities shielded come on the Bodies out of Jersey webpages /dcs, or on the demand.

- Their immigration condition is frequently provided on your Biometric Residence Allow (BRP), that you’ll consider using the ‘consider my BRP condition’ services.

Yet not, they often times hold loads of You shares, so they require an income tax Pact on the United states. Very again, everything becoming equal, these types of fund could be more expensive and you will smaller income tax successful for those folks whom wear’t live in the Uk. Once you buy investment trust shares in the London Stock-exchange you pay 0.5% stamp responsibility (Just like having personal company offers). Even if you is fortunate enough to utilize a patio one to lets you keep fund, it’s unrealistic you are in a position to put fresh currency. Not only that, but everything becoming equivalent, these finance is often more costly and less taxation efficient.

Institutions and businesses

It protection extends to personal membership and holds a comparable visibility for every member of the case from a shared account. Monetary security try an important consideration whenever starting a savings account in the uk. The fresh Economic Characteristics Payment System (FSCS) are a legal fund in the united kingdom which provides payment in order to consumers of authorised financial services businesses in case of their inability.

International Football Situations Effect on U.S. Charge Regulations

That it count is vital since it is familiar with tune your own Federal Insurance coverage benefits and benefits. When it’s instead of your BRP, you can sign up for you to from Department to possess Works and Pensions (DWP). If the BRP try missing, taken, otherwise busted, you should apply for an upgraded.

It’s required to request the official Uk authorities website otherwise an excellent court professional for the most upwards-to-time information on costs linked to your unique situation. Which have ILR, you need to use the fresh Federal Wellness Service (NHS) for your medical care. ILR also can function as first step to your bringing British citizenship in the future.

In case your payor has not reminded you to submit another one to, they are going to keep back income tax in the an apartment 31% rates. But not, you may find that they do not refund the brand new taxation personally for you. Quite often, this is because it’s got started sent to the newest Irs and you may have to file a 1040NR in order to reclaim the new more than percentage. A difficult, practical elderly resident courses a keen idealistic more youthful doctor as a result of 1st day, pull straight back the newest curtain about what very happens, each other good and bad, within the modern-date drug. You might be finalized out of your account should you choose maybe not do anything within the next .

If your obtained ILR inside the deception otherwise was offered refugee condition, you are sensed an immigration alien and you can deal with deportation. This consists of times for example on account of getting away from United kingdom for two or higher ages, if your Home office thinks you gotten your own ILR condition fraudulently, malicious or violent conduct, terrorist activity, and. If the lost otherwise stolen BRP try valid for 90 days or higher, declaration it thereby applying to own an upgraded inside 3 months out of which have they destroyed otherwise taken. You could potentially next win back the newest Exit to keep condition for those who need to settle returning to The uk.

Categorised in: Uncategorized

This post was written by vladeta

Comments are closed here.